WikiFX는 독립적인 제3자 정보 서비스 플랫폼으로서 사용자에게 포괄적이고 객관적인 브로커 규제 정보 서비스를 제공하는 데 전념하고 있습니다. WikiFX는 외환 거래 활동에 직접적으로 참여하지 않으며, 어떤 형태의 거래 채널 추천이나 투자 조언도 제공하지 않습니다. WikiFX의 브로커 등급과 평점은 공개적으로 이용 가능한 객관적인 정보를 기반으로 하며 다양한 국가 및 지역의 규제 정책 차이를 고려합니다. 브로커 등급과 평점은 WikiFX의 핵심 제품이며, 당사는 그들의 객관성과 공정성을 손상시킬 수 있는 상업적 행위에 단호히 반대합니다. 당사는 전 세계 사용자의 감독과 제안을 환영합니다. 신고 핫라인: report@wikifx.com

- 팔로우

- 상업

- 게시물

telegram电报GN518

팔로우

Global regions, payment channels, deposit and withdrawal channels, payment interfaces

TG: @uuifff5978

팔로우

forex construction forex crm software Setup white label

Exclusive customized MT5 platform and license application, professionally arranged for you! Discounts are being offered

Professionally built, stable goals, superior technology, reasonable prices, and all the services of a time-honored brand are in place

Alpha Trade

팔로우

Alpha TRADE: Lobricity service experts in the foreign exchange market help to grasp the pulse of the market

In recent years, the fiery foreign exchange transactions have attracted many investors to settle in, and they have even put forward increasingly diverse demand for liquid service providers. In the safe -oriented foreign exchange market, it is important to choose a suitable liquidity service provider. Alpha Trade, which has a 55 -year -old market experience in the fields of foreign exchange, off -site derivatives and various differences, has a 55 -year -old market experience, is one of the liquid service providers that have been trusted by customers.

Alpha TRADE mainly serves the brokerage as a city merchant, sovereign wealth fund, hedge fund, ultra -high net worth family office, and retail customers, and tailor them to do high -quality liquidity services they need.

In the foreign exchange trading market, liquidity is one of the most important elements of creating profit transactions. In terms of liquidity services, Alpha Trade has the right to speak in the market: on the one hand, benefits from bank institutions such as HSBC HSBC Bank, Credit Suisse Swiss, BarclayS Barclays Bank, UBS UBS, Citibank Citibank Bank, etc., so that Alpha Trade has sufficient liquidity; on the other hand, in the technical field, Alpha Trade has powerful user interface software suitable for professional traders, as well as services such as API interfaces and plugins suitable for high -frequency transactions and algorithms. This diversity ensures that no matter whether the customer is interested in foreign exchange, stock/stock index, gold or digital assets, Alpha Trade can provide corresponding trading tools and technical support, thereby helping customers reduce data information delays, and prioritize the optimal quotation. Increase the success rate of investor transactions.

It is worth mentioning that "safe transactions" have always been a topic that every customer of the foreign exchange market is particularly concerned. As a professional first -class liquidity service provider, Alpha Trade imposes multiple protection mechanisms in terms of capital security transactions to truly ensure customer security security.

First, if customers want to obtain maximum safety, they must choose a liquidity supplier that is effectively regulated. Alpha Trade follows the strict and formal international financial regulatory standards and has successfully obtained the Australian ASIC license. Under the authorization and supervision of authoritative financial regulatory agencies, it can provide customers with a truly safe and reliable trading environment.

Second, Alpha Trade also provides customers with a series of security trading tools and functions. For example, Alpha Trade provides a dedicated PAM/MAM system for fund managers. The system helps fund managers efficiently managers to efficiently manage customers through flexible trading distribution, real -time information viewing, customer volume detection, transaction volume and order frequency analysis. Accounts, improve transaction effects and customer satisfaction, and achieve more accurate investment decisions and risk management.

With the diverse development of customers in the foreign exchange market, I believe that Alpha Trade will continue to use the concept and goals of "providing the most competitive liquidity services for multiple categories of assets", adding sufficient and diversified flow to customers' foreign exchange journey Sexual service help helps customers get more convenience and considerable profits in the trading market.

Alpha Trade

팔로우

Alpha Trade Becomes a New Power in Asia

Asia, as one of the fastest growing regions in the world, has a lot of potential and prospects. The recent development speed of Southeast Asia and Central Asia is obvious to all. With the gradual transformation of the global industrial structure, we can expect that the development in the Asian region will be even more rapid in the future.

The financial demand brought about by economic development is also visible to our naked eyes. As one of our key layout priorities, Alpha Trade is ready to lay a solid foundation for expanding into the Asian market and serving financial institutions and customers with demand in the region.

As a leading global financial derivatives provider, under the leadership of founders who have been deeply involved in the industry for 55 years, Alpha Trade mainly services broker-dealers, sovereign wealth funds, hedge funds, ultra-high net worth family offices, and professional/wholesale clients providing them with access to a huge array of financial derivatives that they need. At the same time, we can also provide customized liquidity services for our clients.

This year, we will continue to promote our high-quality business in various regions of the region, which will enable more customers to feel the unique advantages of Alpha Trade and its profound technical heritage. You can pay attention to our official account and our updated consulting trends.

Alpha Trade

팔로우

Alpha Trade liquidity provider provides one-stop trading services for financial investment clients

In the turbulent financial derivatives market, a liquidity supplier named Alpha Trade has become a trusted partner for institutional investors with its excellent professional and high-quality services. Alpha Trade, a financial giant with an Australian financial services license, has been committed to providing customized liquidity solutions for institutional investors since its establishment in the late 1990s.

Behind Alpha Trade is a group of industry elites from investment banking, asset management, and institutional brokerage trader fields. They provide world-class first-class services to institutional investors with rich experience and profound professional knowledge, ensuring that customers receive precise guidance and strong support at every step of the financial derivatives market.

As a one-stop trading service provider, Alpha Trade provides customers with over 2000 trading options for financial instruments through regulated brokers. Customers do not need to switch back and forth between multiple platforms, they can easily trade a large portfolio of derivative tools through a single FIX API or graphical user interface (GUI), greatly improving trading efficiency and convenience.

In addition, Alpha Trade has also optimized and upgraded its swap trading. Through precise market analysis and efficient trading strategies, Alpha Trade can provide customers with more competitive swap pricing. When customers hold overnight positions, they can either earn higher returns (up to 5% increase) or pay lower fees (save up to 5% of costs). This optimization measure undoubtedly brings tangible and visible benefits to customers, and further reflects Alpha Trade's customer-centric service philosophy.

In the face of the future, we believe that Alpha Trade will continue to adhere to the professional, high-quality, and efficient service concept, providing more comprehensive and accurate financial derivative trading services for institutional investors worldwide. Let's wait and witness Alpha Trade's new achievements in continuously refreshing investment benefits for customers in the financial derivatives trading market!

Alpha Trade

팔로우

Alpha Trade breaks through the liquidity dilemma of 2024

In 2024, with the continuous enrichment and increase of market trading strategies, and the wave of international politics and interest disparities, the volatility of gold and the Japanese yen has also shown significant fluctuations. In this environment, we will find that more and more retailers are conflicting with investors, generally involving trading violations. One of the major reasons for this conflict is that retailers lack liquidity or cannot fully meet the frequency of investor strategies, resulting in a large number of sliding points or even negative values, which is the least desirable situation for industry development.

As a leading global liquidity provider, Alpha Trade provides ample liquidity services to retail institutions and high-quality customers in the market through partnerships with dozens of banks, investment banks, and non banking institutions. For some special strategies and trading varieties, we still customize a tailored liquidity plan through the combination and optimization of liquidity plans, providing the most practical guarantee for customer profitability.

And because we are located in data centers in important financial cities around the world, we have always been able to provide customers with stable and fast quotations. Thanks to our good market depth, we can also serve market customers with huge transaction volumes well, allowing them to better gain their market share.

The expertise of Alpha Trade will undoubtedly bring another technological revolution to the Asian region, achieving more professional level investment clients and obtaining substantial returns in the market.

Alpha Trade

팔로우

Alpha Trade adequate liquidity service, multi -type products meet the customer's full -scale investm

In the field of financial investment, different types of transaction products often correspond to different investment liquidity needs. For investors, choosing a supplier that can provide comprehensive and high -quality liquidity services is undoubtedly an important part of protecting the success of investment. In order to meet the different investment needs of customers, the Alpha Trade has continuously polished itself since its establishment, provides professional and comprehensive liquidity services, tailor -made the type of liquidity they need for customers, and helps customers get better investment returns.

Being able to provide sufficient and diversified liquidity services is a major factor that Alpha Trade attracts customers. First of all, Alpha Trade cooperates with HSBC HSBC Bank, Credit Suisse Swiss, Barclays Barclays Bank, UBS UBS Group, Citibank Citi Bank and other top financial institutions to provide sufficient liquidity; second, Alpha Trade has suitable professional traders. The powerful user interface software, as well as the API interface, plug -in and other services that are suitable for high -frequency transactions and algorithm transactions to support, can quickly obtain data information and increase the success rate of investor transactions. Through banks, ECN, POP, non -bank liquidity and special liquidity pools, Alpha Trade can provide liquidity better than all POP providers in the current market.

The diverse product line is also one of the favorables provided by Alpha Trade for customers. Alpha Trade can provide diversified trading products such as foreign exchange, gold, digital assets, stock indexes, and goods to meet the risk preferences and revenue expectations of different investors. In addition, in the face of the main services, the ALPHA Trade can tailor the high -quality liquidity services they need for them to make high -quality liquid services they need.

Through the organic matching of multi -type products through liquidity services, at the same time, with professional trading tools and technical support, Alpha Trade can help customers reduce data information delay, prioritize the optimal quotation, and provide customers with investment diversified liquidity type solutions solutions , Increase the success rate of investors' transactions and help achieve wealth appreciation.

The need for market competition is needed. Choosing a professional, timely, stable, and being able to meet the needs of customized needs is what investors really need. In the future development, Alpha Trade will also adhere to the concept of quality first and professional liquidity, with diversified trading products and sufficient Alpha Trade Liquidity, meet customer diverse investment needs, reduce customer trading costs, and continuously improve customer transactions. Success rate and profitability.

Alpha Trade

팔로우

Alpha Trade: Professional leader of liquidity service, creator of a safe trading environment

A safe and regular liquidity supplier is critical to foreign exchange traders. Especially in the trading of funds, foreign exchange liquidity suppliers that can provide security guarantees are more popular with investors. As a professional liquid service provider, Alpha Trade can provide customers with a safe and stable trading environment, and has a good reputation in the customer group.

Alpha Trade can ensure the security of funds, and strict supervision is a major reason. The existence of supervision can ensure the compliance and transparency of the foreign exchange market, and then protect the rights and interests of investors. Alpha Trade follows strict and formal international financial regulatory standards and has successfully obtained the Australian ASIC license (hereinafter referred to as ALPHA Trade (Australia)). As Australia's financial regulatory agency, ASIC has won widespread recognition of global investors with its strict regulatory standards and efficient execution. In operating under ASIC's regulation, Alpha Trade (Australia) can provide customers with a truly safe and reliable, compliant and transparent trading environment for customers' funds.

Secondly, a series of security trading tools and functions are also the fund security guarantee brought by Alpha Trade to customers. Choose Alpha Trade's fund manager, and can use a dedicated PAM/MAM system. The system can help fund managers efficiently manage customer accounts through flexible transaction distribution, real -time information inspection, customer volume detection, and transaction volume and order frequency analysis. Decisions and risk management, transactions are more secure.

In addition, Alpha Trade and HSBC HSBC Bank, Credit Suisse Swiss, Barclays Barclays Bank, UBS UBS Group, Citibank Citi Bank and other banking institutions cooperate to ensure their sufficient liquidity. At the same time, through ECN, POP, non -bank liquidity, and special liquidity pools, Alpha Trade can provide Alpha Trade Liquidity better than all POP providers in today's market to escort customers' security transactions.

As the amount of funds continues to increase, the customer's security requirements for the platform will be stricter. And Alpha Trade's liquidity supplier will adhere to the bottom line of security, and is committed to providing the most competitive liquidity services for various types of assets. Create a truly safe trading environment to ensure the smooth progress of the transaction.

飞机.Telegram:@YF8001

팔로우

¥Payment channels and docking are established to support various countries and regions.¥

Product details:Payment channels, platform deposit and withdrawal channels, support multiple regions around the world Main body requirements:Not required #Payment#

PBFX Neo

팔로우

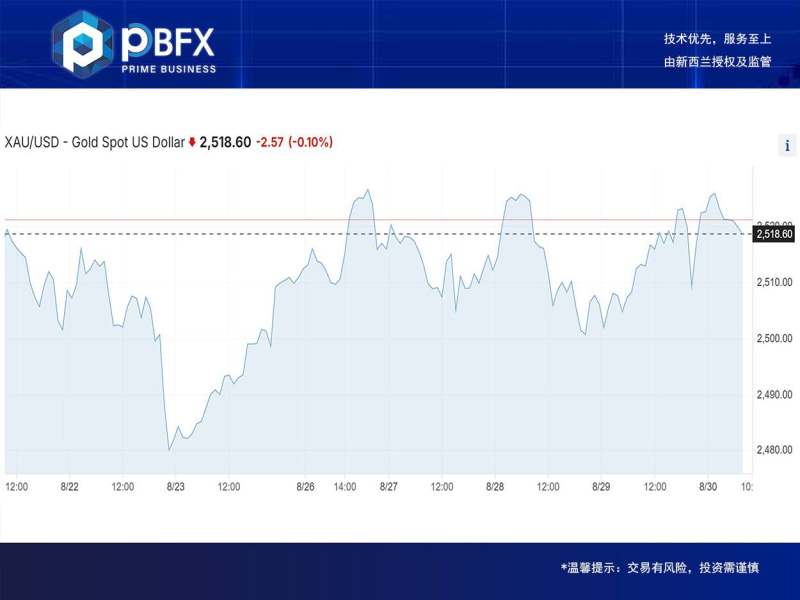

【PBFX | PBFX India】Gold up 0.65%

On Thursday (August 29), gold prices reversed Wednesday's (August 28) decline and returned to record highs, as the US dollar recovered from a 13-month low and was driven by strong expectations of a Federal Reserve interest rate cut in September.

"The expectation now is that the gold market may move sideways at least until the next Fed meeting, but there does seem to be a strong floor of support in the gold market due to geopolitical factors," said one analyst.

Spot gold rose 0.65% to close at $2,521.03 an ounce. COMEX gold futures rose 0.67% to $2,554.70 an ounce.

Operation suggestion: the lowest gold daily line to the position of 2503.2 after the market strong pull up, the highest reached the position of 2528.8 after the market, the final line in the 2521.1 position after the market with a mountain shadow line is very long in the sun line, and after the end of this form, the day line strong washing state, but the cycle break is not far, the point.

Trading strategy: long near 2506, stop loss 2501, target 2521-2550.

더 보기

로그인 / 가입

상업

게시물

관심이 있을 수 있는 사람들

바꾸기

FX1119038861

팔로우

FX1395681821

팔로우

FX1831931952

팔로우

가인

팔로우

FX2492920623

팔로우

저작권 성명

당사는 플랫폼에 게시된 모든 콘텐츠의 저작권은 합법적인 콘텐츠 제공자나 수권을 받은 WikiFX 플랫폼에 속합니다. 당사는 모든 내용의 합법성과 준법성을 보장하기 위해 저작권법과 규정을 철저히 준수합니다.