Score

UnicornFX

Canada|2-5 years|

Canada|2-5 years| https://unicornfx.live/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

00162 12 481 100

Other ways of contact

Broker Information

More

UnicornFX

UnicornFX

Canada

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $100 |

| Minimum Spread | From 0.5 pips |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

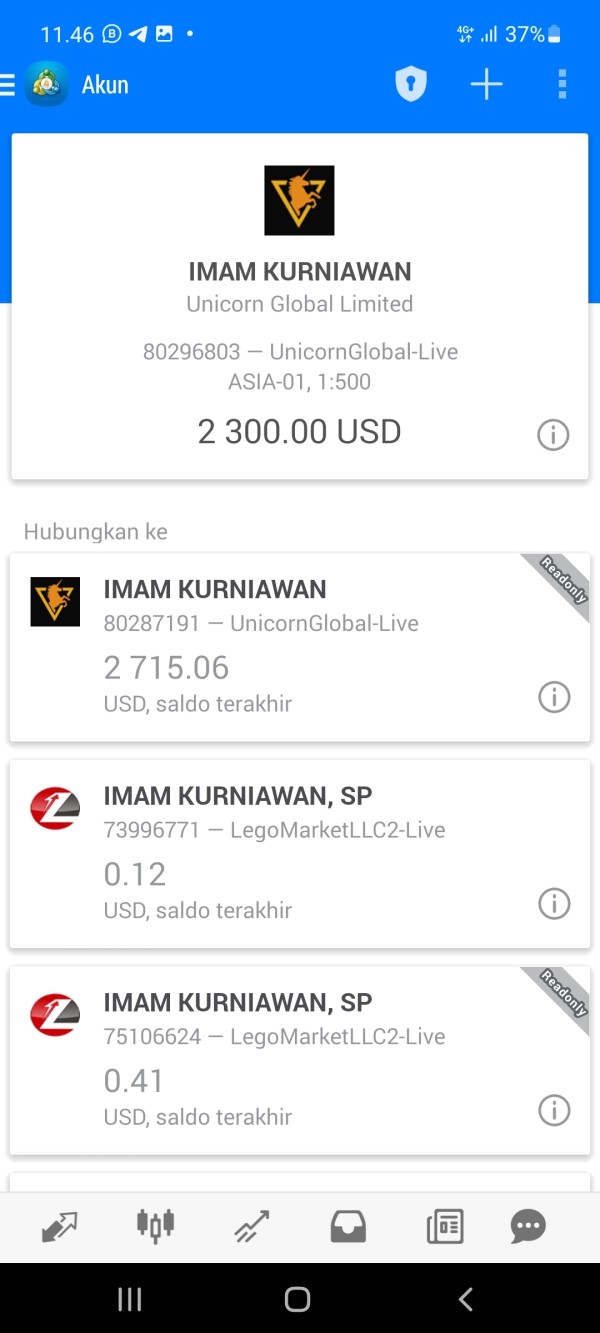

| Maximum Leverage | 1:500 |

| Minimum Deposit | $1000 |

| Minimum Spread | From 1 pips |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $ 5 |

| Minimum Spread | From 3 pips |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed UnicornFX also viewed..

XM

FBS

GTCFX

Exness

UnicornFX · Company Summary

| Aspect | Information |

| Company Name | UnicornFX |

| Registered Country/Area | Canada |

| Founded Year | 2019 |

| Regulation | Not regulated |

| Minimum Deposit | $5 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | From 0.5 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex pairs, cryptocurrencies, indices, commodities, stocks |

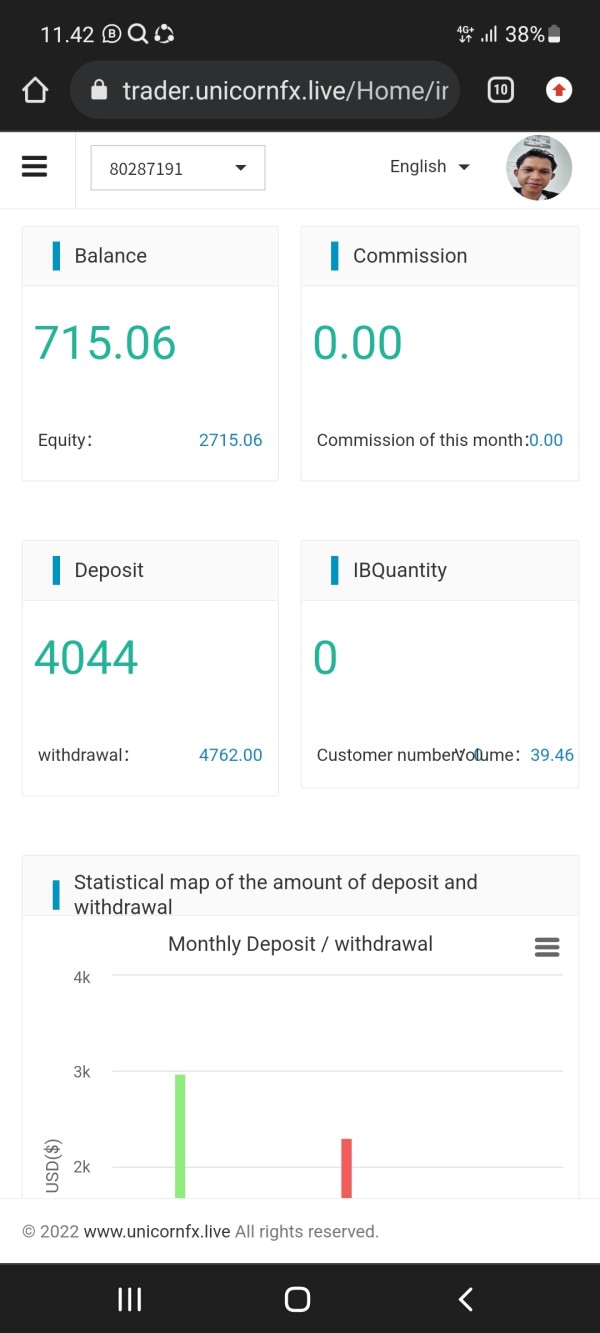

| Account Types | Standard Account, ECN Account, Micro Account |

| Customer Support | Email (SUPPORT@UNICORNFX.TRADE), and phone (+00162 12 481 100) |

| Deposit & Withdrawal | Credit/debit cards, bank transfers, and cryptocurrency |

| Educational Resources | Limited educational resources |

Overview of UnicornFX

UnicornFX, established in Canada in 2019, is a trading platform that offers a wide range of financial products. However, it's essential to note that UnicomFX operates without regulation from any financial authority, which may raise concerns about transparency and oversight. The platform primarily focuses on foreign exchange (Forex) trading but provides a diverse array of products, including major, minor, and exotic Forex pairs, popular cryptocurrencies like Bitcoin and Ethereum, global stock market indices, commodities such as gold and oil, and shares of well-known companies. While UnicomFX caters to traders with varied preferences and risk profiles, its lack of regulatory oversight is a key consideration for those exploring the platform.

Is UnicomFX legit or a scam?

UnicomFX is not regulated by any regulatory authority, which may raise concerns about the transparency and oversight of the exchange.

Unregulated exchanges lack the oversight and legal protections provided by regulatory authorities. This can lead to a higher risk of fraud, market manipulation, and security breaches. Without proper regulation, users may also face challenges in seeking recourse or resolving disputes. Additionally, the absence of regulatory oversight can contribute to a less transparent trading environment, making it difficult for users to assess the legitimacy and reliability of the exchange.

Pros and Cons

| Pros | Cons |

| Diverse Range of Trading Instruments | Lack of Regulatory Oversight |

| Competitive Spreads Starting From 0.5 Pips | Limited Educational Resources |

| Leverage Options Up to 1:1000 | Withdrawal Issues Reported by Some Traders |

| Multiple Account Types | |

| User-Friendly MT4 Trading Platform | |

| Accessible Demo Accounts for Practice |

Pros:

Diverse Range of Trading Instruments: UnicomFX offers a wide variety of financial products and instruments, including Forex pairs, cryptocurrencies, indices, commodities, and stocks.

Competitive Spreads Starting From 0.5 Pips: The platform provides competitive spreads, which can be advantageous for traders seeking cost-effective trading conditions.

Leverage Options Up to 1:1000: Leverage allows traders to control larger positions with a smaller amount of capital, potentially amplifying profits .

Multiple Account Types: UnicomFX caters to various trading needs by offering multiple account types, including Standard, ECN, and Micro accounts, allowing traders to choose the one that best suits their preferences and risk tolerance.

User-Friendly MT4 Trading Platform: MT4 provides a stable environment for executing trades and conducting technical analysis, suitable for traders of all experience levels.

Accessible Demo Accounts for Practice: The availability of demo accounts allows traders to practice and test their trading strategies without risking real capital.

Cons:

Lack of Regulatory Oversight: UnicomFX operates without regulation from any financial regulatory authority. The absence of regulatory oversight raises concerns about transparency, security, and whether the exchange adheres to industry standards.

Limited Educational Resources: The platform lacks comprehensive educational materials such as tutorials, webinars, or articles. This limitation can hinder traders' ability to enhance their trading knowledge and skills.

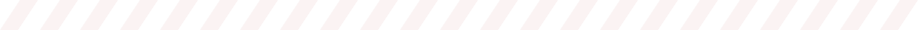

Withdrawal Issues Reported by Some Traders: There have been reported complaints from some traders regarding difficulties with withdrawing funds from their UnicomFX accounts.

Market Instruments

UnicomFX offers a diverse range of financial products and instruments, primarily focused on foreign exchange (Forex) trading. These products cater to traders' varied preferences and risk profiles. The core products available on UnicomFX include:

Forex Pairs: UnicomFX provides access to a wide array of major, minor, and exotic currency pairs. This enables traders to speculate on the relative strength and exchange rates of various global currencies.

Cryptocurrencies: In addition to Forex, UnicomFX also offers trading in popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and others. Traders can take advantage of cryptocurrency price volatility.

Indices: UnicomFX allows traders to participate in the performance of global stock market indices like the S&P 500, Dow Jones, and NASDAQ. This provides exposure to the broader financial markets.

Commodities: Traders can engage in the commodity markets by speculating on the prices of commodities like gold, silver, oil, and more. This offers diversification opportunities.

Stocks: UnicomFX enables users to trade shares of well-known companies listed on major stock exchanges worldwide, including tech giants, banks, and other industry leaders.

Account Types

UnicomFX offers a range of account types to cater to the diverse needs of traders.

The Standard Account, with a maximum leverage of 1:1000, requires a minimum deposit of $100 and boasts competitive spreads starting from as low as 0.5 pips. Traders in this account type can take advantage of supported Expert Advisors (EAs) and utilize the MT4 trading platform. Additionally, a demo account is available for practice.

For those seeking a more advanced trading experience, the ECN Account offers a maximum leverage of 1:500, with a higher minimum deposit requirement of $1,000. Spreads start from 1 pip, and traders can access the same MT4 platform along with EAs and demo accounts.

On the other hand, the Micro Account is suitable for traders with smaller budgets, as it requires a minimum deposit of just $5. It offers a maximum leverage of 1:1000 and competitive spreads starting from 3 pips.

| Aspect | Standard Account | ECN Account | Micro Account |

| Maximum Leverage | 1:1000 | 1:500 | 1:1000 |

| Minimum Deposit | $100 | $1,000 | $5 |

| Minimum Spread | From 0.5 pips | From 1 pip | From 3 pips |

| Supported EA | Yes | Yes | Yes |

| Demo Account | Yes | Yes | Yes |

| Trading Tools | MT4 | MT4 | MT4 |

| Customer Support | 24/7 | 24/7 | 24/7 |

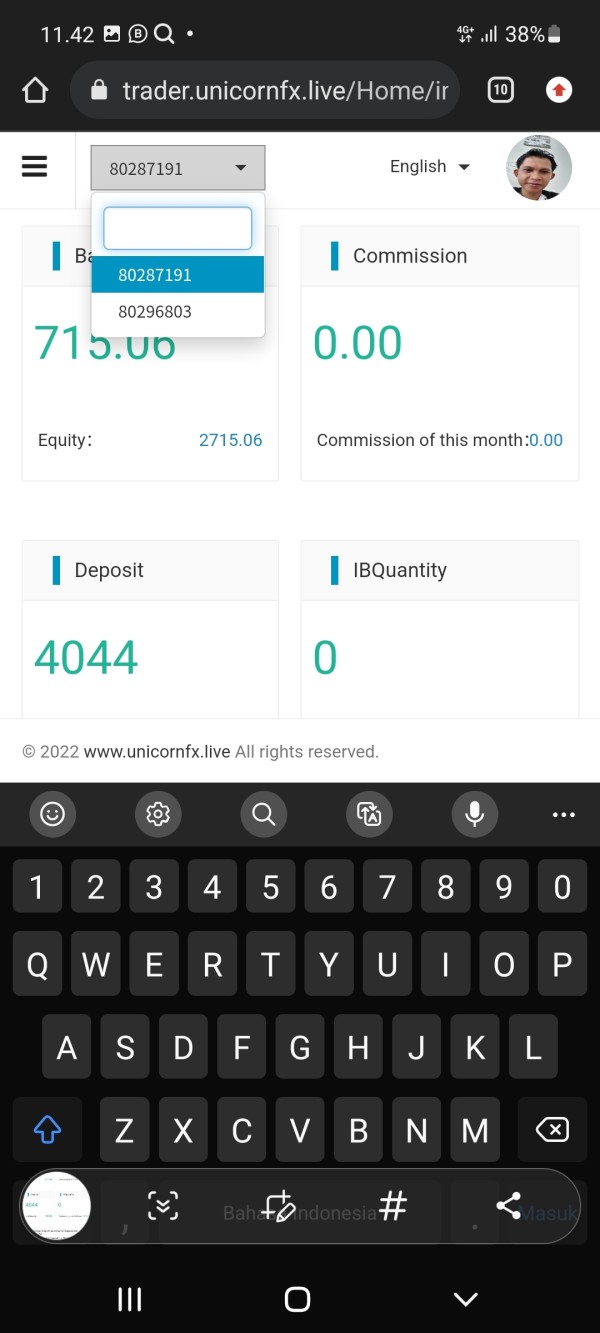

How to Open an Account?

To open an account with UnicomFX, follow these simple steps:

Registration: Visit the UnicomFX website and click on the “Sign Up” or “Register” button. Provide your personal information, including your name, email, and phone number. Create a secure password, agree to the terms and conditions, and click “Register.”

Verification: Log in to your newly created UnicomFX account. Complete the identity verification process by submitting required documents such as a government-issued ID and proof of address. This step ensures security and compliance.

Deposit Funds: Once verified, deposit funds into your account using the available payment methods, which may include bank transfers, credit/debit cards, or cryptocurrencies.

Choose Account Type: Select the account type that suits your trading needs, whether it's a Standard Account, ECN Account, or Micro Account.

Start Trading: Access the trading platform, which is MT4, and choose your preferred trading instruments. Execute trades based on your strategy and risk tolerance.

Leverage

UnicomFX offers varying leverage options across its account types. The Standard Account provides a maximum leverage of 1:1000, while the ECN Account offers a leverage of 1:500. The Micro Account, suitable for traders with smaller budgets, also offers a maximum leverage of 1:1000.

| Aspect | Standard Account | ECN Account | Micro Account |

| Maximum Leverage | 1:1000 | 1:500 | 1:1000 |

Spreads & Commissions

UnicomFX features different minimum spreads depending on the chosen account type. The Standard Account offers spreads starting from as low as 0.5 pips, while the ECN Account provides spreads starting from 1 pip. For the Micro Account, the minimum spread begins from 3 pips.

| Aspect | Standard Account | ECN Account | Micro Account |

| Minimum Spread | From 0.5 pips | From 1 pip | From 3 pips |

Trading Platform

UnicomFX utilizes the widely recognized MetaTrader 4 (MT4) trading platform, a choice adopted by many brokers in the industry. MT4 is well-regarded for its stability and functionality, offering traders a robust environment for executing trades and conducting technical analysis.

One of the notable aspects of the MT4 platform is its user-friendly interface. Traders of varying experience levels, from beginners to seasoned professionals, find it relatively intuitive to navigate. Its accessibility is often cited as a strong point, allowing users to quickly adapt to the platform's features.

MT4 offers a range of charting tools and technical indicators, empowering traders with the ability to conduct in-depth analysis of market trends and price movements. These tools include a variety of chart types, technical indicators, and customizable timeframes, which can assist traders in making informed decisions.

Furthermore, MT4 supports automated trading through the use of Expert Advisors (EAs). This feature enables traders to implement algorithmic strategies and automate trading activities based on pre-defined criteria.

Deposit & Withdrawal

UnicomFX offers a variety of deposit and withdrawal methods, including:

Credit/debit cards

Bank transfers

Cryptocurrency

UnicomFX sets varying minimum deposit requirements based on account types. The Standard Account requires a minimum deposit of $100, the ECN Account necessitates $1,000, and the Micro Account offers a lower minimum deposit of just $5. UnicomFX imposes no fees for depositing or withdrawing funds, ensuring a cost-effective experience for its traders.

| Aspect | Standard Account | ECN Account | Micro Account |

| Minimum Deposit | $100 | $1,000 | $5 |

Deposit and withdrawal processing times vary depending on the payment method used. Credit/debit card deposits are processed instantly, while bank transfers may take up to 5 business days to process. Cryptocurrency deposits are processed within 24 hours.

Customer Support

UnicomFX offers 24/7 customer support via live chat, email, and phone. For English-speaking users, you can reach them at +00162 12 481 100. Additionally, you can contact them via email at SUPPORT@UNICORNFX.TRADE. Their multiple contact options ensure that users can get assistance and inquiries addressed conveniently.

Educational Resources

UnicomFX offers limited educational resources, primarily comprising an FAQ section. While it provides some basic information, the platform lacks comprehensive educational materials such as tutorials, webinars, or articles that could assist traders in enhancing their trading knowledge and skills. Traders considering UnicomFX should be aware that they may need to seek supplementary educational resources elsewhere to build a solid foundation in trading.

Conclusion

UnicornFX offers a diverse range of trading instruments, including Forex, cryptocurrencies, indices, commodities, and stocks. This variety caters to traders with different preferences and risk profiles. The platform provides competitive spreads, leverage options up to 1:1000, and multiple account types, making it accessible to a wide range of traders. Additionally, the user-friendly MT4 trading platform and accessible demo accounts for practice enhance the trading experience.

However, UnicornFX faces drawbacks, such as the absence of regulatory oversight, which may raise concerns about transparency and security. Limited educational resources can hinder traders' skill development, and reported withdrawal issues have affected some users. Despite its strengths, potential users should carefully consider both the advantages and disadvantages of UnicornFX before trading on the platform.

FAQs

Q: Is UnicornFX regulated by any financial authority?

A: No, UnicornFX is not regulated by any regulatory authority.

Q: What are the available account types on UnicornFX?

A: UnicornFX offers Standard, ECN, and Micro accounts to cater to different trading needs.

Q: What is the maximum leverage offered by UnicornFX?

A: UnicornFX provides leverage options up to 1:1000, depending on the chosen account type.

Q: Are there any educational resources available on UnicornFX?

A: UnicornFX primarily offers an FAQ section but lacks comprehensive educational materials.

Q: How can I contact UnicornFX customer support?

A: You can reach UnicornFX customer support via live chat, email (SUPPORT@UNICORNFX.TRADE), and phone (+00162 12 481 100).

Q: What financial products can I trade on UnicornFX?

A: UnicornFX offers Forex pairs, cryptocurrencies, indices, commodities, and stocks for trading.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now