Score

Truist Financial

Japan|1-2 years|

Japan|1-2 years| https://www.truistjpfx.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Truist Financial

Truist Financial

Japan

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed Truist Financial also viewed..

XM

IC Markets Global

AUS GLOBAL

GO MARKETS

Truist Financial · Company Summary

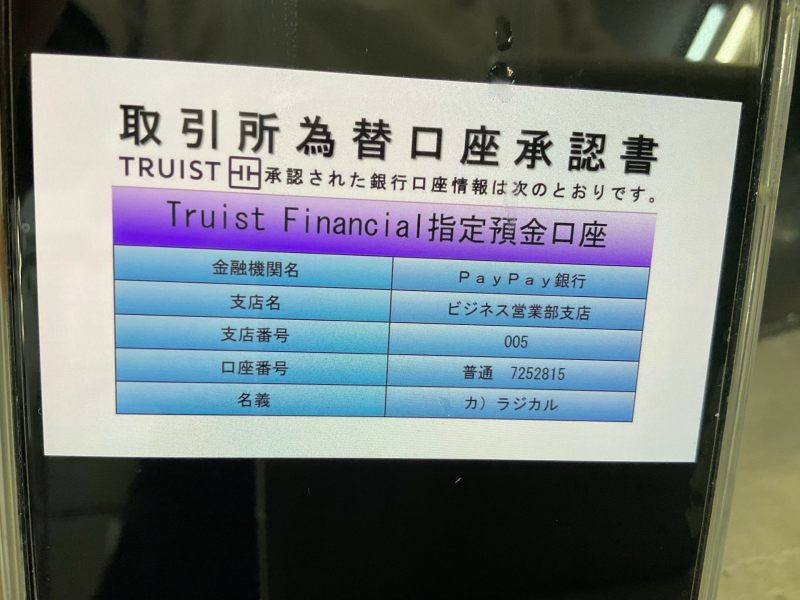

| Aspect | Information |

| Company Name | Truist Financial |

| Registered Country/Area | Japan |

| Founded Year | 2023 |

| Regulation | Unauthorized |

| Minimum Deposit | 1000 yen |

| Market Instruments | Forex,Commodities,Crypto currencies |

| Spreads&commissions | As low as 0 pip |

| Trading Platforms | MT4,MT5 platform |

| Demo Account | Available |

| Customer Support | Website:https://www.truistjpfx.com/ |

| Deposit & Withdrawal | Bank transfer,debit card/credit card |

Overview of Truist Financial

Truist Financial, founded in 2023 and based in Japan, is an emerging financial company that is not yet authorized under regulatory bodies.

Specializing in various market instruments such as Forex, commodities, and cryptocurrencies, they offer an account with a minimum deposit requirement of 1000 yen. Truist Financial is known for its competitive spreads and commissions, advertising rates as low as 0 pip.

The company provides its services through popular trading platforms like MT4 and MT5 and also offers a demo account for practice trading.

While their customer support can be accessed through their website at https://www.truistjpfx.com/, they accept deposits and withdrawals through bank transfers as well as debit and credit cards.

Is TRUIST Limited Legit or a Scam?

The National Futures Association (NFA) lists TRUIST FINANCIAL CORPORATION as an unauthorized entity under its regulatory overview.

Despite claiming a Common Financial Service License, the company does not have official authorization or regulation in the United States, as indicated by the absence of a valid license number (0559849 being listed without authorization).

Furthermore, the NFA does not provide an effective date or an email address for the licensed institution, suggesting a lack of formal communication channels.

Pros and Cons

| Pros | Cons |

| Diverse Market Instruments | Unauthorized and Unregulated |

| Competitive Spreads and Commissions | Lack of Transparency |

| Advanced Trading Platform | Restricted License Information |

| Demo Account Availability | Risk of Financial Loss |

| Multiple Payment Options | Limited Track Record |

Pros of Truist Financial Corporation:

Diverse Market Instruments: Truist Financial offers a range of trading options including Forex, commodities, and cryptocurrencies, catering to various investor interests.

Competitive Spreads and Commissions: The company advertises low spreads and commissions, potentially as low as 0 pip, which can be advantageous for traders seeking cost-effective trading.

Advanced Trading Platforms: They provide access to popular and sophisticated trading platforms like MT4 and MT5, which are favored by many traders for their advanced features and user-friendly interfaces.

Demo Account Availability: Truist Financial offers demo accounts, allowing new and inexperienced traders to practice and develop their trading skills without financial risk.

Multiple Payment Options: The company accepts deposits and withdrawals through convenient methods like bank transfers, debit cards, and credit cards, providing ease of transactions for its clients.

Cons of Truist Financial Corporation:

Unauthorized and Unregulated: The company is not authorized or regulated by any known financial regulatory body, particularly in the United States as indicated by the National Futures Association, which raises significant concerns about its legitimacy and safety.

Lack of Transparency: There is a lack of clear information regarding the companys regulatory status, effective dates, and contact details, which suggests potential issues with transparency and reliability.

Restricted License Information: The mention of “No Sharing” in its license type could imply limitations in the dissemination of crucial regulatory information, further obscuring the company's operational legitimacy.

Risk of Financial Loss: Without proper regulatory oversight, clients funds and investments might be at higher risk, lacking the protection that comes with dealing with a fully licensed and regulated financial institution.

Limited Track Record: As a company founded in 2023, Truist Financial lacks a long-standing history or track record in the financial market, which might make it difficult for potential clients to assess its performance and reliability over time.

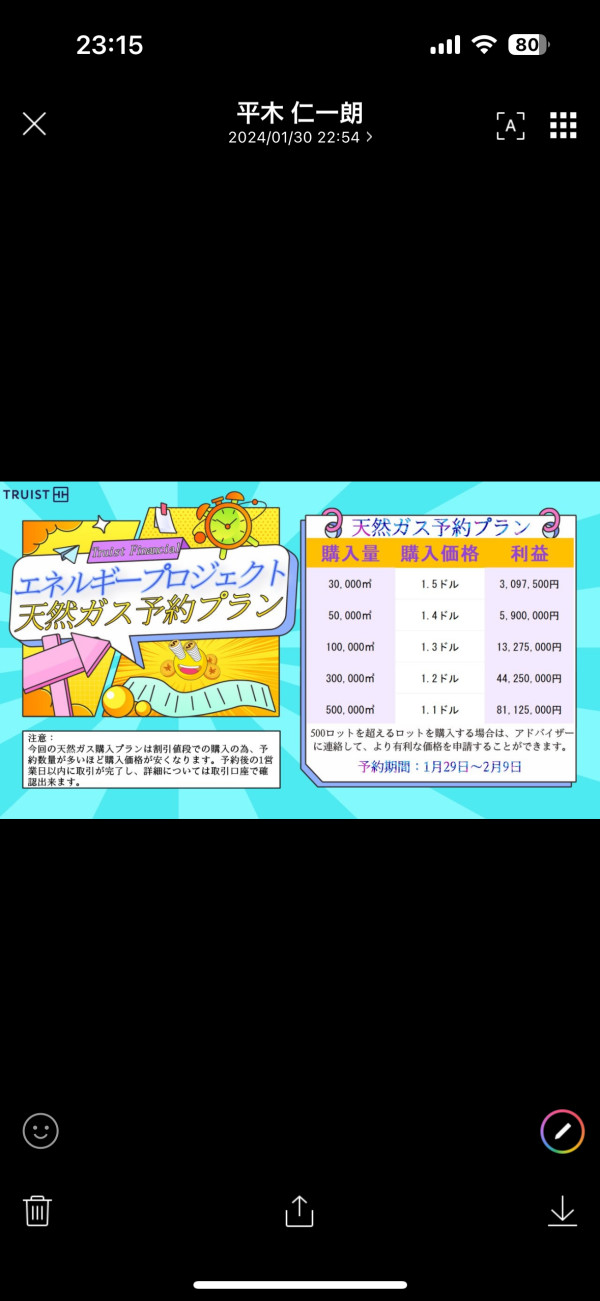

Market Instruments

The market instruments offered by Truist Financial Corporation include:

Forex (Foreign Exchange): This involves the trading of currencies, allowing traders to speculate on the fluctuating values of different currencies against each other.

Commodities: Truist Financial provides opportunities to trade in various commodities, which may include precious metals, energy products like oil and gas, and agricultural products such as grains and coffee.

Cryptocurrencies: The company offers trading in various cryptocurrencies, enabling clients to speculate on the digital currency market which includes popular cryptocurrencies like Bitcoin, Ethereum, and others.

How to Open an Account?

Opening an account with Truist Financial Corporation can generally be done in the following four steps:

Visit the Official Website: Start by navigating to the official Truist Financial Corporation website. Look for the section or link that says “Open an Account,” “Register,” or something similar.

Complete the Registration Form: Fill in the registration form with your personal details. This usually includes information like your name, address, email, phone number, and sometimes financial information or trading experience. Ensure that all information provided is accurate and up-to-date.

Verification of Identity and Documents Submission: As part of the Know Your Customer (KYC) process, you will be required to verify your identity. This typically involves uploading government-issued identification documents such as a passport or drivers license, and possibly a proof of address like a utility bill or bank statement.

Fund Your Account: Once your account is set up and verified, you will need to deposit funds to start trading. Choose your preferred method of deposit, such as bank transfer or credit/debit card, and transfer the minimum required amount or more based on your trading needs.

After these steps, you should be able to access your account and start trading with the instruments offered by Truist Financial Corporation.

Spreads & Commissions

Truist Financial Corporation advertises its spreads and commissions as being “As low as 0 pip.” This suggests a highly competitive pricing structure, particularly in terms of spreads:

Low Spreads: A spread of as low as 0 pip implies that the difference between the bid and ask price for a trading instrument can be extremely narrow, potentially offering traders the opportunity to enter and exit trades with minimal transaction costs.

Commissions: While the specific commission structure is not listed, the emphasis on low spreads suggests that Truist Financial might offer a low-commission or even a commission-free trading environment.

It's essential for traders to understand that while low spreads and commissions are attractive, they should also consider other factors such as the reliability of the platform, execution speed, and the overall regulatory environment before opening an account.

Trading Platform

Truist Financial Corporation offers trading services through two popular and widely-used trading platforms: MT4 (MetaTrader 4) and MT5 (MetaTrader 5). These platforms are renowned in the trading community for their robust features and user-friendly interfaces:

MT4 (MetaTrader 4): MT4 is one of the most popular trading platforms in the world, known for its ease of use and powerful analytical tools. It provides advanced charting capabilities, numerous technical indicators, and supports automated trading through Expert Advisors (EAs).

MT5 (MetaTrader 5): MT5 is the successor to MT4 and offers all the features of its predecessor, along with additional capabilities. It supports more instruments, including stocks and commodities, and comes with an extended set of technical indicators, graphical objects, timeframes, and more advanced charting tools.

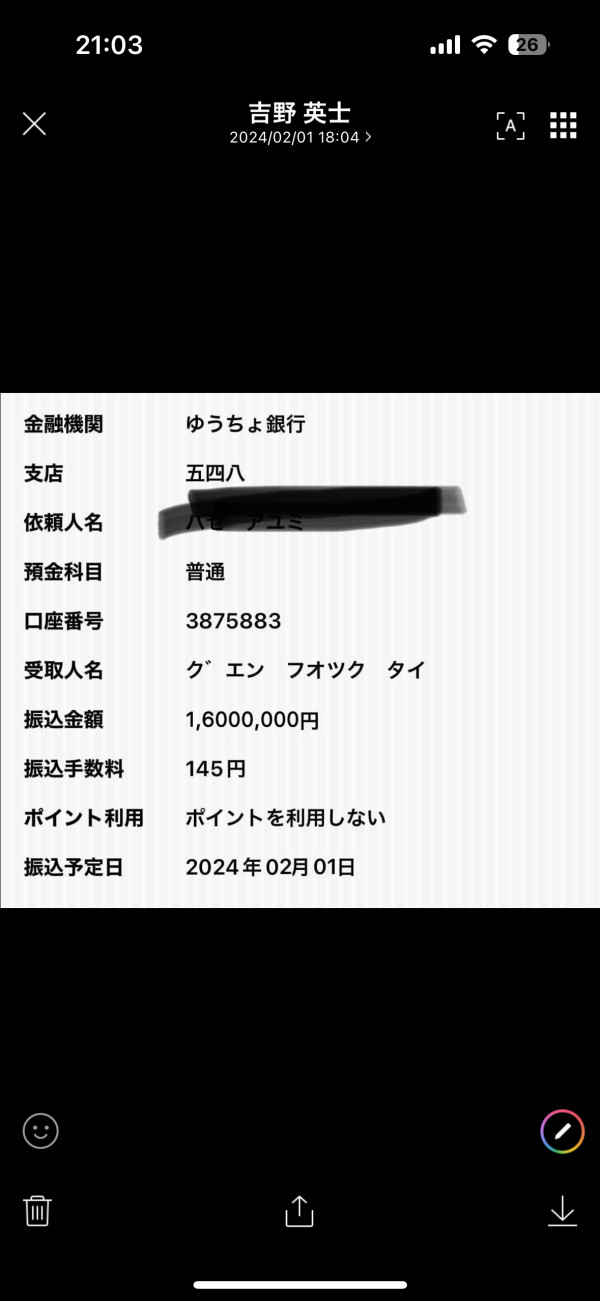

Deposit & Withdrawal

Truist Financial Corporation offers several options for deposit and withdrawal, catering to the convenience of its clients. The company has set a minimum deposit requirement to ensure accessibility for a wide range of traders:

Minimum Deposit: The minimum amount required to open an account with Truist Financial is 1000 yen. This relatively low threshold makes it accessible for individuals who wish to start trading with a smaller capital investment.

Payment Methods: Truist Financial accepts deposits through bank transfers and debit/credit cards. These methods are widely used and are convenient for most traders. Bank transfers are reliable and suitable for larger transfers, while debit and credit card deposits are often faster and might be more convenient for smaller, more frequent deposits.

Processing Times and Fees: The processing times and any associated fees for both deposits and withdrawals can vary depending on the method chosen and the terms set by Truist Financial.

It's important for clients to review these details to understand any potential costs or delays in accessing their funds.

Customer Support

Truist Financial Corporation provides customer support primarily through its website, which can be accessed at https://www.truistjpfx.com/.

This online presence likely offers various means of support, such as email, contact forms, or possibly live chat options, allowing clients to reach out for assistance with their accounts, trading queries, or any technical issues they might encounter.

Conclusion

In conclusion, Truist Financial Corporation, established in 2023 in Japan, presents itself as a modern financial trading platform offering a range of market instruments like Forex, commodities, and cryptocurrencies.

The company appeals to personal traders through competitive spreads and commissions, and the provision of advanced trading platforms such as MT4 and MT5. The low minimum deposit requirement and multiple options for deposits and withdrawals add to its accessibility.

However, potential clients should exercise caution due to the company's current unauthorized status and lack of transparency in regulatory matters.

While it offers online customer support through its website, the overall reliability and safety of investments with Truist Financial should be carefully considered due to the regulatory concerns.

FAQs

Q:Is Truist Financial Corporation regulated?

A:Truist Financial Corporation is not authorized or regulated by any major financial regulatory body.

Q:What is the minimum deposit required to open an account?

A:The minimum deposit required to open an account with Truist Financial Corporation is 1000 yen.

Q:Which trading platforms does Truist Financial Corporation offer?

A:The company offers trading on MT4 (MetaTrader 4) and MT5 (MetaTrader 5) platforms.

Q:What are the deposit and withdrawal methods available?

A:Deposits and withdrawals can be made through bank transfers, and debit or credit cards.

Q:How competitive are the spreads and commissions?

A:The company advertises its spreads and commissions as being as low as 0 pip.

Q:How can I contact customer support?

A:Customer support can be accessed through the companys website at https://www.truistjpfx.com/.

News

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now