Score

KVB PRIME

United Kingdom|5-10 years| Benchmark C|

United Kingdom|5-10 years| Benchmark C|https://kvbprime.co.uk/

Website

Rating Index

Benchmark

Benchmark

C

Average transaction speed (ms)

MT4/5

Full License

KVBPrimeUK-Demo

Ireland

IrelandInfluence

D

Influence index NO.1

China 2.64

China 2.64Benchmark

Speed:B

Slippage:D

Cost:AA

Disconnected:D

Rollover:C

MT4/5 Identification

MT4/5 Identification

Full License

Ireland

IrelandInfluence

Influence

D

Influence index NO.1

China 2.64

China 2.64Surpassed 61.79% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

KVB PRIME (UK) Limited

KVB PRIME

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

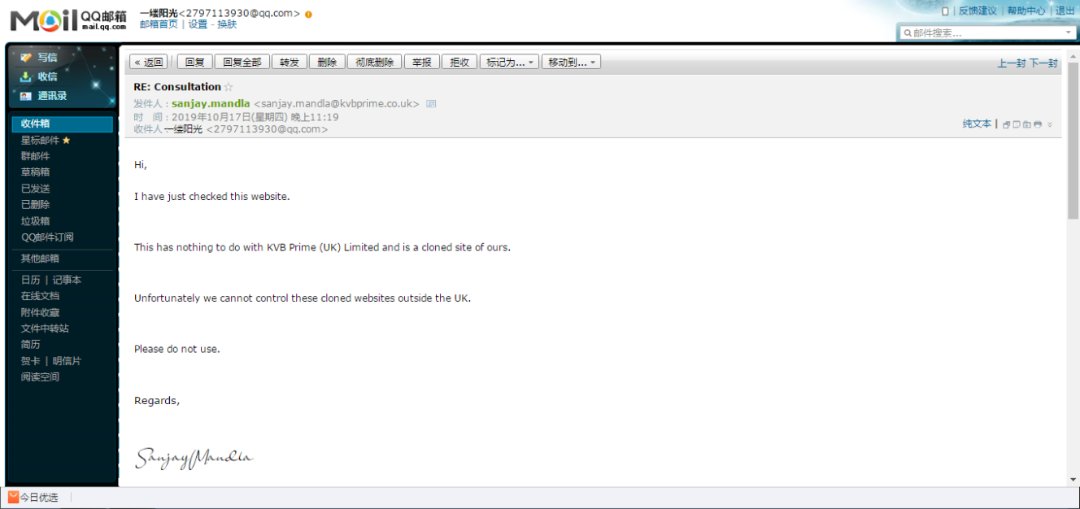

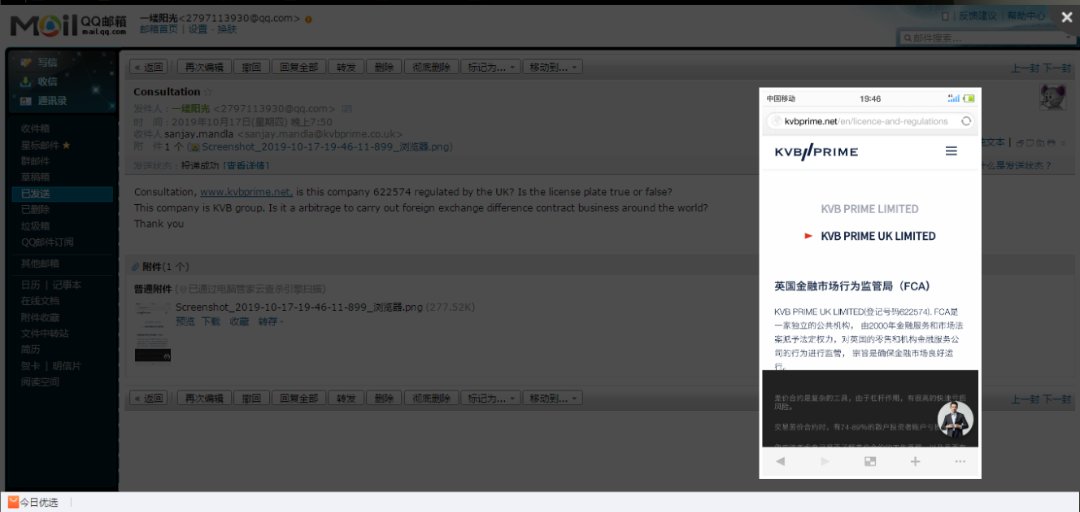

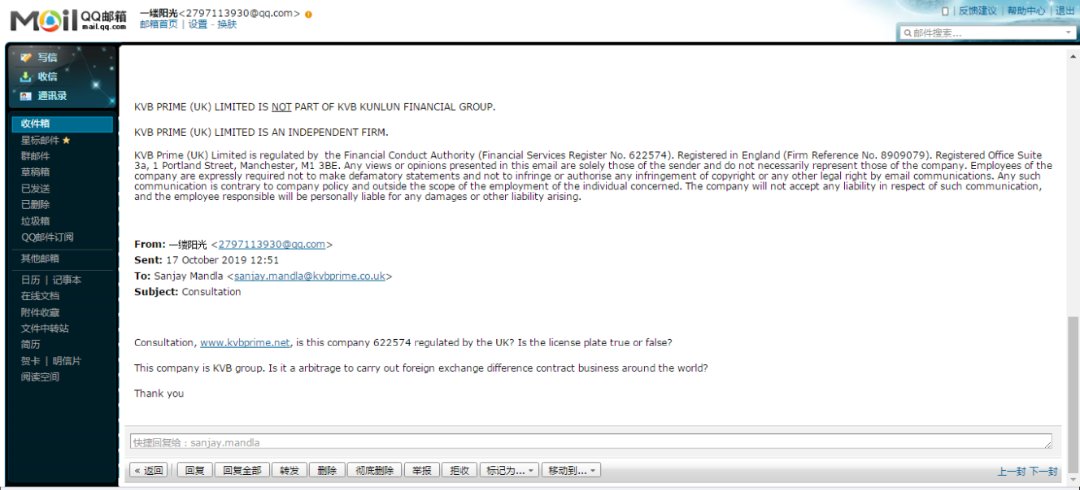

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 80 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The United KingdomFCA regulation (license number: 622574) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed KVB PRIME also viewed..

XM

AUS GLOBAL

KCM Trade

FP Markets

Total Margin Trend

- VPS Region

- User

- Products

- Closing time

Hongkong

Hongkong- 556***

- XAUUSD.e

- 09-11 16:05:20

silicon valley

silicon valley- 519***

- XAUUSD.e

- 09-11 16:14:26

HoChiMinh

HoChiMinh- 181***

- XAUUSD.e

- 09-11 16:05:33

Stop Out

0.76%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

KVB PRIME · Company Summary

| Aspect | Information |

| Registered Country/Area | Samoa |

| Founded Year | 1-2 years |

| Company Name | KVB PRIME Limited |

| Regulation | Not regulated |

| Minimum Deposit | USD 1 |

| Maximum Leverage | Up to 1:800 |

| Spreads | Starting from 0 pips |

| Trading Platforms | MetaTrader 4 (MT4), KVB PRIME APP, COPYTRADE |

| Tradable Assets | Forex, Commodities, Shares, Indices, Cryptocurrencies |

| Account Types | Prime Account, ECN Account, Demo Account |

| Demo Account | Available |

| Islamic Account | Not mentioned |

| Customer Support | Email, phone (for Greater China and European clients), live chat, contact form |

| Payment Methods | Bank card, NB deposits, USDT deposits |

| Educational Tools | Real-time market quotes, insights, technical analysis, forex trading basics, educational videos |

| Promotions | Gold Trading Race promotion |

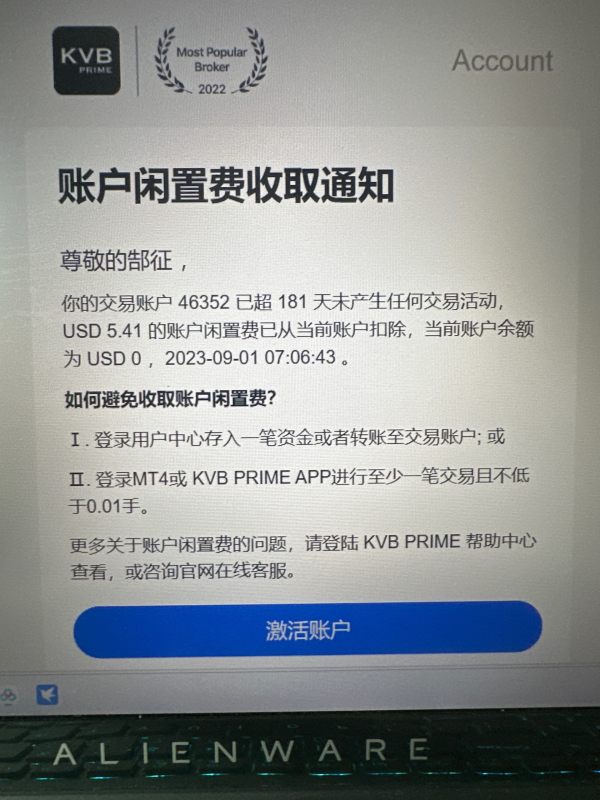

| Inactivity Fee | USD 10 deducted after 181 consecutive inactive days |

| Reviews | Mixed reviews, including complaints about inactivity fee and pyramid scheme concerns |

Overview of KVB PRIME

KVB PRIME is a relatively new trading platform based in Samoa, operating for 1-2 years. It operates without regulatory oversight, which raises concerns about the lack of formal supervision by financial authorities or governing bodies. Traders and investors considering its services should exercise caution and conduct thorough due diligence due to potential risks associated with the absence of regulation.

The platform offers a range of trading instruments, including Forex, commodities, shares, indices, and cryptocurrencies. However, the absence of regulation may impact the safeguards and protections available to traders.

KVB PRIME provides different account types, including PRIME and ECN accounts, with various leverage options. Additionally, a demo account is available for practice. The platform offers a mobile trading app, MetaTrader 4, and a copy trading service.

While KVB PRIME offers educational tools, including market quotes, insights, technical analysis, and resources for beginners, traders should be aware of potential non-trading fees, such as an inactivity fee. Additionally, reviews on platforms like WikiFX highlight customer concerns, including complaints related to a pyramid scheme and dissatisfaction with inactivity fee deductions. Traders should carefully consider these factors before engaging with KVB PRIME's services.

Pros and Cons

KVB PRIME offers a diverse range of trading options, including Forex, Commodities, Shares, Indices, and Cryptocurrencies, with leverage options reaching up to 1:800. The platform provides spreads starting at 0 pips and offers valuable educational resources for traders. However, it's important to note the lack of regulatory oversight, which could result in limited safeguards. Additionally, KVB PRIME imposes an inactivity fee after 181 consecutive inactive days and may have minimum withdrawal requirements, potentially causing delays for large withdrawals. Payment methods are also somewhat limited, and there have been complaints related to pyramid schemes and inactivity fee deductions.

| Pros | Cons |

| Provides Forex, Commodities, Shares, Indices, and Cryptocurrencies | Lack of regulatory oversight, potentially limited safeguards |

| Leverage options up to 1:800 | Imposition of an inactivity fee after 181 consecutive inactive days |

| Spreads starting at 0 pips | Minimum withdrawal amounts and potential delays for large withdrawals |

| Provides educational tools and resources for traders | Limited types of payment methods |

| Multiple trading platforms available | Complaints related to pyramid schemes and inactivity fee deductions |

Is KVB PRIME Legit?

KVB PRIME operates without regulatory oversight, which means it lacks formal supervision by financial authorities or governing bodies. This absence of regulation can pose potential risks to traders and investors, as there may be limited safeguards and protections in place compared to regulated entities. Traders should exercise caution and conduct thorough due diligence before engaging with KVB PRIME's services.

Market Instruments

FOREX:

KVB PRIME offers a selection of Forex (Foreign Exchange) instruments, including AUDCAD, AUDCHF, and AUDJPY. These instruments enable traders to engage in global currency trading, capitalizing on fluctuations in currency values. Each Forex instrument comes with its own spread, leverage ratio, and trading hours, providing traders with options to suit their trading strategies and preferences.

COMMODITIES:

KVB PRIME provides access to the commodities market through instruments like XAGUSD (Silver) and XAUUSD (Gold). These commodities can be traded with varying spreads and leverage ratios. Traders can take advantage of price movements in precious metals, diversifying their portfolios and potentially benefiting from market volatility.

SHARES:

The platform also offers shares of well-known companies like Apple Inc (#AAPL), Advanced Micro Devices Inc (#AMD), Amazon.com Inc (#AMZN), and Broadcom (#AVGO). These share instruments feature consistent spreads and leverage ratios, allowing traders to invest in the stock market and participate in the performance of these companies.

INDICES:

Indices such as DAX (German Stock Index), NIKKEI (NIKKEI Index), and HSI (Heng Seng Index) are available for trading on KVB PRIME. These instruments represent the performance of specific stock markets and provide traders with exposure to broader market trends. Each index instrument has its own spread, leverage ratio, and trading hours.

CRYPTOCURRENCIES:

KVB PRIME offers a selection of cryptocurrencies, including AVAXUSD (Avalanche), BCHUSD (BitCoin Cash), BNBUSD (BNB), and BTCUSD (BitCoin). These cryptocurrency instruments feature fixed percentage-based swap rates and trading schedules, allowing traders to participate in the fast-moving and dynamic crypto markets.

| Pros | Cons |

| Provides diverse range of trading options | Lack of regulatory oversight may pose risks |

| Offers exposure to global currency trading | Variable spreads and leverage ratios for commodities |

| Access to well-known company shares | Different trading hours for various instruments |

Account Types

PRIME ACCOUNT:

The PRIME account type is a versatile option suitable for both novice and experienced traders. It offers a wide range of leverage options, including 1:100, 1:200, 1:400, and 1:800. This account operates on Market Execution and features a floating spread starting from 1.5 pips. The Stop Out level for PRIME accounts is set at 100%.

ECN ACCOUNT:

The ECN account type requires an initial deposit of 2000 USD and offers leverage options of 1:100, 1:200, 1:400, and 1:800. Similar to the PRIME account, ECN operates on Market Execution but provides a floating spread starting from 0 pips. The Stop Out level for ECN accounts is also set at 100%.

Additionally, KVB PRIME offers a demo account with virtual funds, allowing users to practice trading on the platform without financial risk. Creating a demo account is a straightforward process through the MT4 platform, with server selection as KVBPrimeLimited-Demo.

| Pros | Cons |

| PRIME account offers a wide range of leverage options, catering to various trader levels | ECN account requires a higher initial deposit of 2000 USD |

| Demo account available for risk-free practice trading | Demo account details and benefits are not specified in the provided text |

| Spreads from 0 |

How to Open an Account?

Opening an account with KVB PRIME involves the following steps:

1. Click “CREATE ACCOUNT”: Visit the KVB PRIME website and locate the “CREATE ACCOUNT”.

2. Select Your Country/Region: Choose your country or region from the provided options.

3. Enter Your Email: Input your valid email address in the designated field.

4. Verification Code: Enter the verification code as provided or required by the platform.

5. Register: Click on the “立即注册” or “Register” button to complete the account creation process.

Leverage

KVB PRIME offers a floating leverage option with a maximum ratio of 1:800.

Spreads

KVB PRIME offers spreads starting at a minimum of 0. This means that traders may encounter spreads as low as zero pips on certain trading instruments, potentially reducing trading costs and enhancing opportunities for profit.

Non-Trading Fees

KVB PRIME imposes an inactivity fee, which is triggered after 181 consecutive inactive days. In such cases, the system deducts USD 10 from the account balance every 30 days until the account reaches a balance of USD 10 or less, at which point the deductions cease. If the account balance reaches 0, no further charges are applied.

Minimum Deposit

The minimum deposit amount per transaction at KVB PRIME is USD 1, with a maximum limit of USD 75,000. Daily deposit limits may vary depending on the local banking system and the user's region.

Deposit & Withdrawal

KVB PRIME provides various deposit methods, including bank card, NB deposits, and USDT deposits. Deposits are credited instantly, and there is a minimum withdrawal amount of USD 500 for CN customers and USD 20 for non-CN customers for bank transfers. NB withdrawals require a minimum of 1 NB, and USDT withdrawals have a minimum of USDT 20. Withdrawals are typically processed within 1-3 days, with potential delays for large withdrawal amounts. The platform offers three withdrawal methods: NB, USDT, and bank card, and users can initiate withdrawals through the user center by selecting their preferred method.

| Pros | Cons |

| Offers multiple deposit methods | Minimum withdrawal amount of USD 500 for CN customers and USD 20 for non-CN customers |

| Deposits are credited instantly | Potential delays for large withdrawal amounts |

| Provides various withdrawal options | Withdrawals may take 1-3 days to process |

Promotions

KVB PRIME is currently running the Gold Trading Race promotion in celebration of the upcoming Mid-Autumn Festival. This promotion is open to all KVB PRIME clients, with registration available from August 28, 2023, to September 24, 2023. The competition itself will take place from September 4, 2023, to October 1, 2023. Participants must register with a minimum deposit of USD 500 on a selected live trading account. The promotion features a leaderboard updated regularly, offering cash rewards to top-performing traders. Rewards will be distributed within 15 working days after the promotion concludes. Rankings are determined based on a points system, considering factors like Gold Net Profit Points, Gold Trading Volume Points, and Net Deposit Points. This promotion provides traders with an opportunity to win prizes and enhance their trading experience.

Trading Platforms

META TRADER 4: MetaTrader 4 (MT4) is a widely recognized trading platform known for its industry-standard status. It offers an intuitive user interface and a feature-rich environment for traders. Some of its key features include the ability to chart assets, place orders, and manage positions. Traders using MT4 can work with nine different timeframes, analyze quote dynamics in detail, view multiple charts simultaneously, overlay analytical objects, and utilize preprogrammed analytical tools. The platform also offers over 50 built-in indicators and tools, making it a versatile choice for traders.

KVB PRIME APP: The KVB PRIME APP is a mobile trading software developed in-house. It offers features like market quotations, charting, transaction capabilities, account management, deposit/withdrawal options, and market information. Users can access real-time market data, open and close positions quickly, modify orders, and manage their accounts on the go. The app also offers account customization, real-time fund settlement, and access to the latest market news.

COPYTRADE (Automatic Trading): COPYTRADE is a system offered by a third-party service provider, FOLLOWME. It functions as a trading community where global users can connect and interact. Traders can share their trading experiences, showcase strategies, and exchange information. Users can copy the trades of experienced traders automatically. The process involves connecting their trading accounts, subscribing to trading “Signal” providers, and copying their orders. FOLLOWME has over 500,000 registered users from more than 170 countries. Traders can subscribe to multiple Signal providers based on their preferences and risk tolerance, paying a subscription fee, typically around $30/month. The platform also provides risk control tools for users.

| Pros | Cons |

| MetaTrader 4 (MT4) offers a feature-rich trading environment | Details are limited |

| MT4 provides an intuitive user interface | |

| COPYTRADE allows users to automatically copy experienced traders' strategies |

Educational Tools

KVB PRIME provides a range of educational tools to help traders make informed decisions. They offer real-time market quotes for instruments like AUDCHF, GBPNZD, #NKE, #PG, and #V, allowing traders to monitor price movements closely over different timeframes. These quotes provide essential information for technical analysis and decision-making.

In addition to market quotes, KVB PRIME offers insights and news articles. These insights cover topics such as political developments and their potential impact on markets, as well as discussions on the value of assets like gold to investors. These insights provide traders with contextual information to consider when making trading decisions.

Furthermore, KVB PRIME offers technical analysis for specific currency pairs like NZD/JPY and USD/JPY, helping traders identify potential entry and exit points. This technical analysis assists traders in developing their trading strategies based on market trends and support and resistance levels.

Technical analysis is another aspect covered by KVB PRIME, offering information on specific currency pairs like NZD/JPY and USD/JPY. This technical analysis provides intraday guidance and alternative scenarios, assisting traders in their decision-making process.

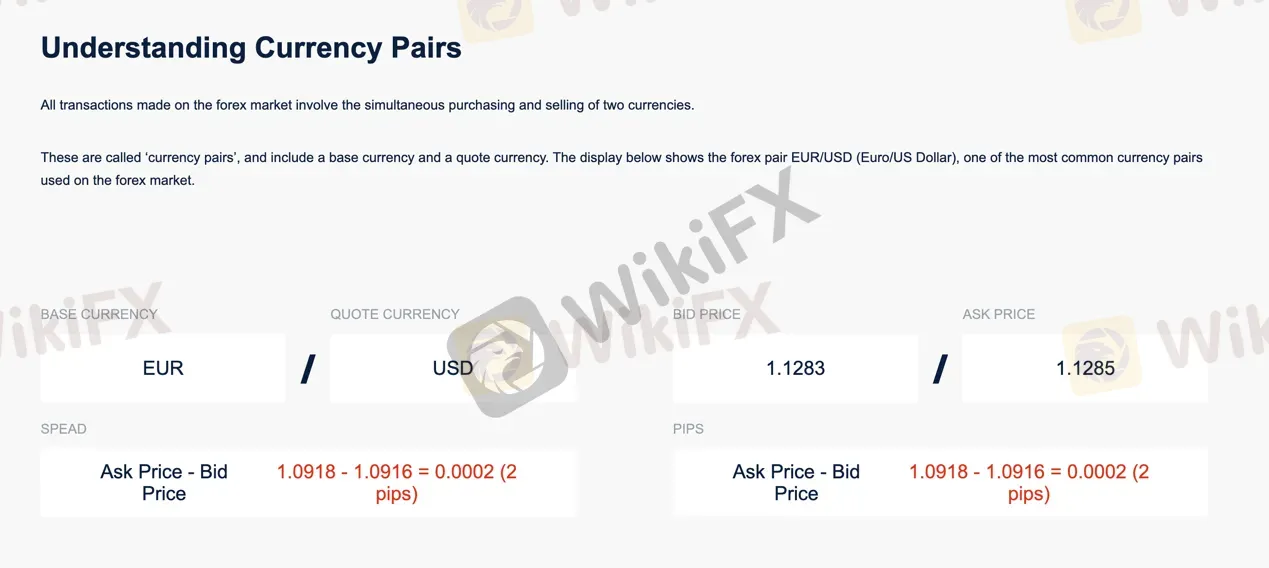

For beginners, KVB PRIME offers educational resources on forex trading basics, including explanations of the forex market, forex trading, and forex brokers. Traders can learn about currency pairs, their bid and ask prices, and the concept of pips. These resources are particularly helpful for those new to forex trading, helping them understand the fundamentals.

Lastly, KVB PRIME offers educational videos that cover trading guidelines, company branding, and media-related content. These videos provide additional learning materials for traders seeking to enhance their knowledge and skills in the financial markets.

Customer Support

KVB PRIME offers customer support tailored to its Greater China and European clients. For Greater China, customers can reach out via email at support@kvbprime.com or call 400-886-7005 during service hours from 07:30 to 23:00 (UTC+8). European customers can also contact support via email at support@kvbprime.com during the same service hours. Additionally, live chat support is available for quick assistance. If you have inquiries or issues related to KVB PRIME's services, you can reach out by providing your name, email, phone number, and problem description through their contact form.

Reviews

A review of KVB PRIME on WikiFX reveals a single exposure, primarily concerning a complaint related to a pyramid scheme. Additionally, the review highlights a customer's experience with an inactivity fee deduction. The customer had a balance of $5.41 in their trading account, and they were charged the inactivity fee without prior notification or awareness, leading to dissatisfaction and a perception of unfair treatment.

Conclusion

In conclusion, it's important to consider both its advantages and disadvantages. On the positive side, the platform offers a diverse range of trading instruments, including Forex, commodities, shares, indices, and cryptocurrencies. It also provides multiple account types to cater to different trading preferences and skill levels. Furthermore, KVB PRIME offers a variety of educational tools, including real-time market quotes, insights, technical analysis, and educational resources, which can be beneficial for traders seeking to improve their knowledge. However, a significant drawback is the lack of regulatory oversight, which may raise concerns about the safety and security of traders' investments. Additionally, the platform imposes an inactivity fee, and there have been complaints related to this fee, which could impact the overall user experience. Therefore, traders should exercise caution and carefully consider the risks associated with trading on an unregulated platform like KVB PRIME.

FAQs

Q1: Is KVB PRIME a regulated financial institution?

A1: No, KVB PRIME operates without regulatory oversight, which means it lacks formal supervision by financial authorities or governing bodies.

Q2: What are the available market instruments for trading on KVB PRIME?

A2: KVB PRIME offers Forex, Commodities, Shares, Indices, and Cryptocurrencies for trading.

Q3: What are the account types offered by KVB PRIME?

A3: KVB PRIME offers PRIME accounts and ECN accounts, suitable for both novice and experienced traders. They also provide a demo account for practice.

Q4: How can I open an account with KVB PRIME?

A4: To open an account with KVB PRIME, visit their website, select your country/region, enter your email, complete the verification process, and register.

Q5: Does KVB PRIME charge inactivity fees?

A5: Yes, KVB PRIME imposes an inactivity fee if an account remains inactive for 181 consecutive days, deducting USD 10 every 30 days until the account balance reaches USD 10 or less.

Review 97

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now