Score

Power Trading

Hong Kong|1-2 years| Benchmark A|

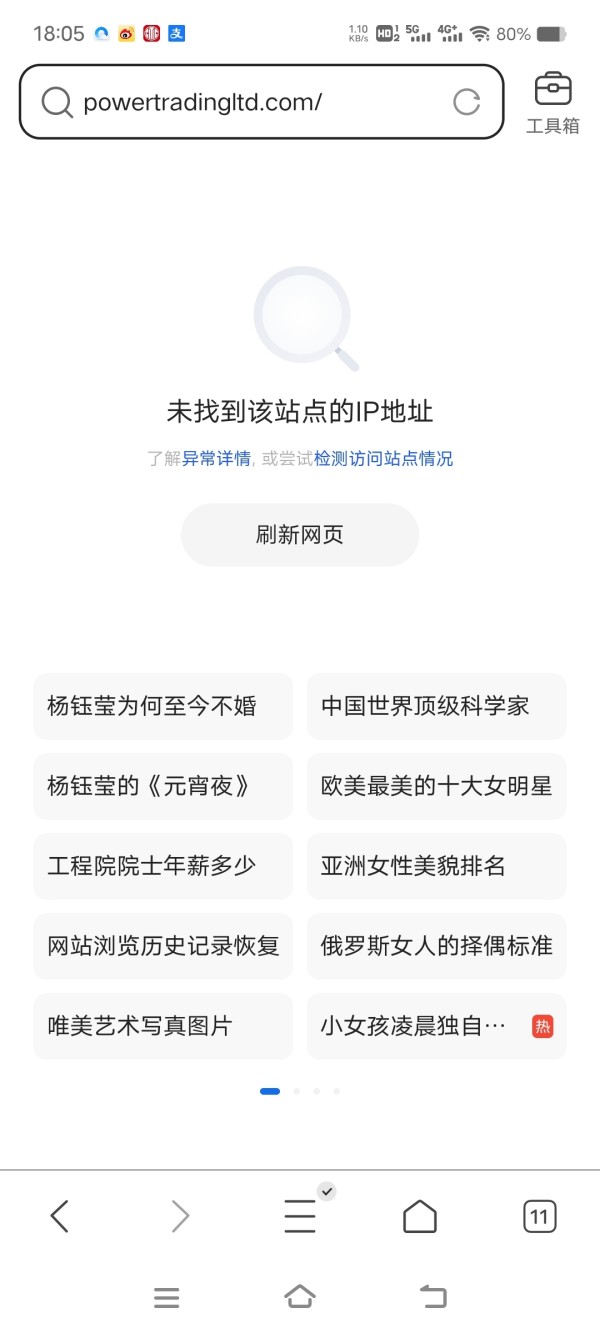

Hong Kong|1-2 years| Benchmark A|https://powertrader.world/

Website

Rating Index

Benchmark

Benchmark

A

Average transaction speed (ms)

MT4/5

Full License

PowerTrading-Live

Hong Kong

Hong KongBenchmark

Speed:AAA

Slippage:AA

Cost:C

Disconnected:A

Rollover:C

MT4/5 Identification

MT4/5 Identification

Full License

Hong Kong

Hong KongContact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Power Trading Limited

Power Trading

Hong Kong

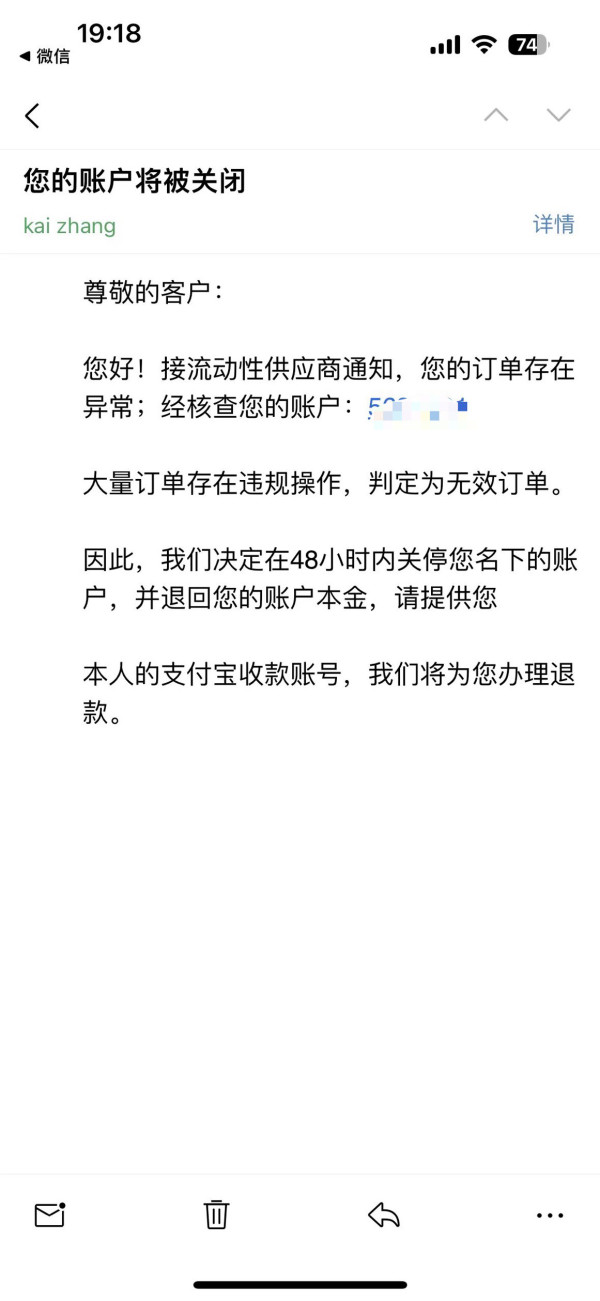

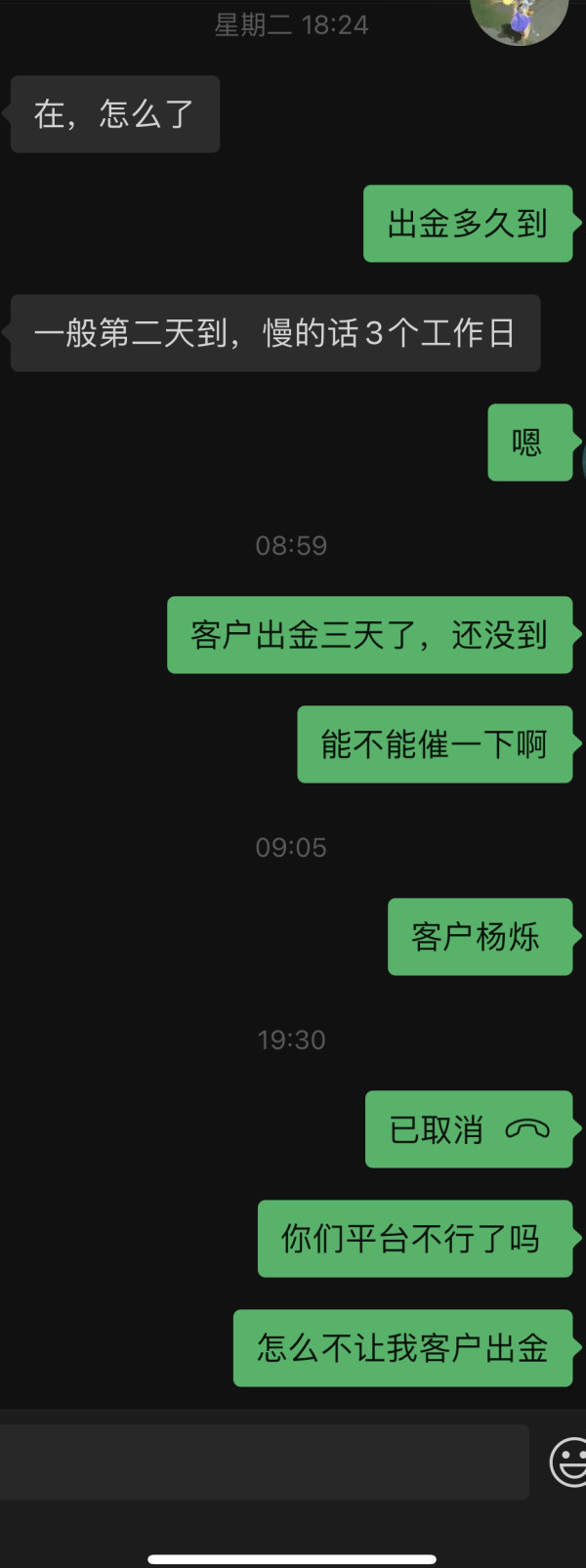

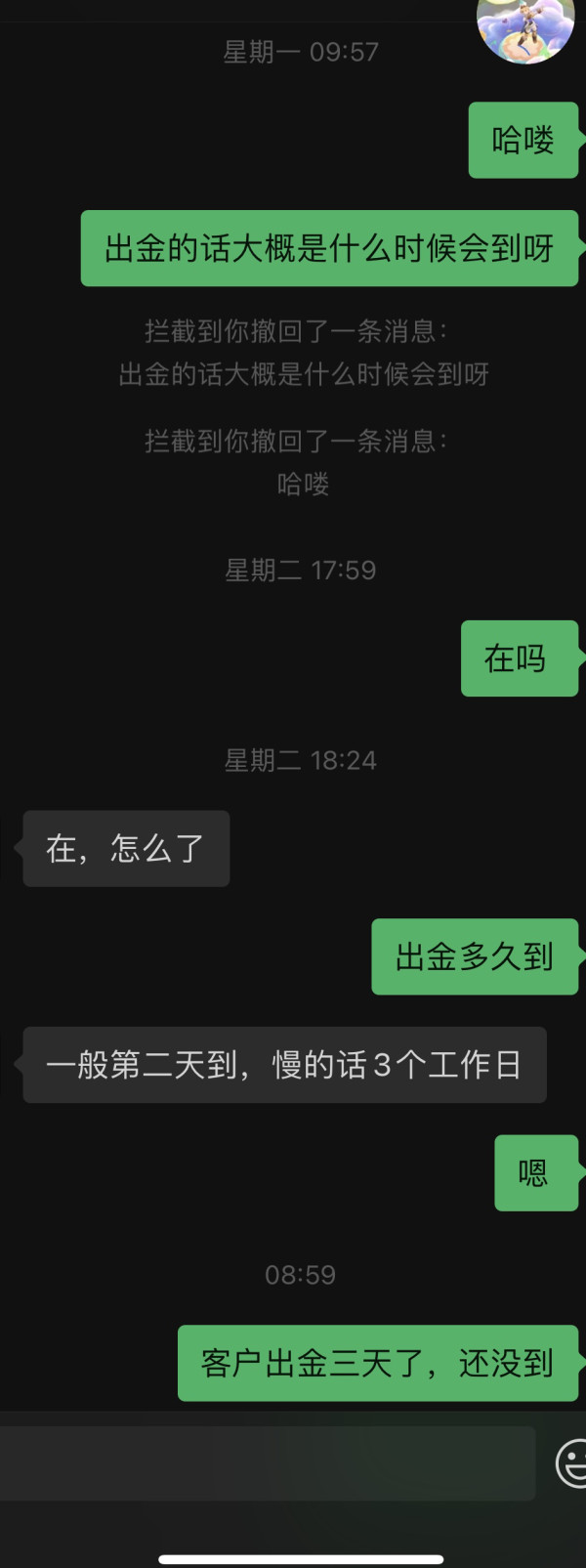

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

WikiFX Verification

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Power Trading also viewed..

XM

GO MARKETS

EC Markets

FBS

Power Trading · Company Summary

| Power Trading | Basic Information |

| Founded | 2023 |

| Headquarters | Hong Kong |

| Regulation | ASIC |

| Tradable Assets | Forex pairs, precious metals, CFDs, crude oil contracts |

| Account Types | STP (Straight Through Processing), ECN (Electronic Communication Network) |

| Minimum Deposit | STP Account: >=100 USD |

| ECN Account: >=5000 USD | |

| Maximum Leverage | STP Account: 1:1 - 1:400 |

| ECN Account: 1:1 - 1:300 | |

| Spreads | STP Account: Floating from 1.9 pips |

| ECN Account: Zero for major currency pairs | |

| Commission | ECN Account may involve commission fees based on trade volume or a flat fee per trade |

| Trading Platform | MetaTrader 4 (MT4) |

| Customer Support | Email: admin@powertradingltd.com |

Overview of Power Trading

Power Trading, established in 2013 and headquartered in Hong Kong, operates as a regulated brokerage under the oversight of the Australia Securities & Investment Commission (ASIC). As an Appointed Representative (AR), Power Trading adheres to regulatory standards to ensure transparency and integrity in its operations. The company offers a diverse range of tradable assets, including forex pairs, precious metals, contracts for difference (CFDs), and crude oil contracts.

With a focus on providing accessible trading opportunities, Power Trading offers two main types of trading accounts: STP (Straight Through Processing) and ECN (Electronic Communication Network). These accounts feature flexible leverage options and competitive spreads, allowing traders to tailor their trading strategies according to their risk appetite and market outlook. Additionally, the brokerage provides a user-friendly trading platform in the form of MetaTrader 4 (MT4), renowned for its reliability and advanced charting capabilities.

Committed to supporting traders at every step of their journey, Power Trading offers a range of educational resources, including real-time market news updates, forex market analysis, and comprehensive educational materials covering fundamental and technical analysis.

Pros & Cons

Power Trading presents itself as a regulated brokerage, offering a sense of security and adherence to industry standards. Their commitment to educational resources is commendable, providing traders with valuable insights into market dynamics. Additionally, the responsive customer support ensures that traders can seek assistance promptly when needed.

However, the platform doesn't provide a clear commission structure.

| Pros | Cons |

|

|

| |

|

Is Power Trading Legit?

Power Trading is regulated by the Australia Securities & Investment Commission (ASIC). It operates under an Appointed Representative (AR) and is subject to regulatory oversight by the Australian authorities. Its license number is 001307402. As a regulated entity, Power Trading is required to adhere to the rules and regulations set forth by ASIC. This regulatory framework provides a level of transparency and accountability, instilling confidence among traders regarding the legitimacy and reliability of Power Trading's operations.

Trading Instruments

Power Trading offers a diverse range of trading instruments to cater to the varying needs and preferences of traders. Among the available options are foreign exchange (forex) pairs, providing opportunities to trade major, minor, and exotic currency pairs. Forex trading allows investors to speculate on the fluctuations in exchange rates between different currencies, offering potential profit opportunities from currency price movements.

Additionally, Power Trading offers trading in precious metals such as gold and silver. Precious metals are popular commodities in the financial markets, valued for their intrinsic properties and as safe-haven assets during times of economic uncertainty. Traders can capitalize on the price movements of gold and silver through derivative products, enabling them to participate in the precious metals market without owning physical assets.

Another trading instrument available through Power Trading is contracts for difference (CFDs). CFDs are financial derivatives that allow traders to speculate on the price movements of various underlying assets, including stocks, indices, commodities, and cryptocurrencies, without actually owning the underlying asset. CFD trading offers flexibility and leverage, enabling traders to potentially profit from both rising and falling markets.

Furthermore, Power Trading facilitates trading in crude oil, a crucial commodity in the global economy. Crude oil is one of the most actively traded commodities, with its price influenced by various factors such as geopolitical events, supply and demand dynamics, and macroeconomic trends. Traders can take advantage of the volatility in oil prices by speculating on crude oil futures contracts, allowing them to profit from price fluctuations in the oil market.

Account Types

Power Trading offers two main types of trading accounts: STP (Straight Through Processing) and ECN (Electronic Communication Network). The STP account operates on an STP-ECN trading model, ensuring fair and transparent order execution by facilitating direct market access. This model aims to eliminate delays and re-quotes by executing orders directly in the international market, without any intervention from third parties. Power Trading employs stable and efficient server systems to execute all orders promptly and seamlessly, providing clients with the best possible user experience.

The STP account type features floating spreads and requires a minimum initial deposit of at least 100 USD, with subsequent deposits starting from 100 USD. Traders have the flexibility to adjust their leverage within a range of 1:1 to 1:400 and can trade micro-lots with a minimum trade size of 0.01 standard lots. Additionally, the STP account supports automated trading (Expert Advisors) and imposes no restrictions on maximum position sizes.

On the other hand, the ECN account offers zero spreads, providing traders with direct access to interbank liquidity and the ability to trade at the best available prices with minimal transaction costs. This account type requires a higher minimum initial deposit of at least 5000 USD, with subsequent deposits starting from 100 USD. Traders can adjust leverage within a range of 1:1 to 1:300 and trade micro-lots with a minimum trade size of 0.01 standard lots. The ECN account is suitable for experienced traders seeking direct market access and competitive pricing.

How to Open an Account?

To open an account with Power Trading, follow these steps.

- Visit the Power Trading website. Look for the “Login” button on the homepage and click on it.

2. Look for the “Create an account” button and sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

Power Trading offers flexible leverage options to accommodate the varying risk preferences and trading strategies of its clients. Leverage allows traders to control larger positions in the market with a smaller amount of capital, thereby amplifying potential profits. With leverage ratios ranging from 1:1 to 1:400 for STP accounts and 1:1 to 1:300 for ECN accounts, traders have the flexibility to adjust their leverage based on their individual risk tolerance and market outlook.

For example, a leverage ratio of 1:100 means that for every $1 of capital deposited, the trader can control a position worth $100 in the market. This magnifies both potential profits and losses, making leverage a powerful tool that requires careful consideration and risk management. While higher leverage ratios offer the potential for greater returns, they also entail increased risk, as even small market movements can lead to significant gains or losses.

Spreads & Commissions

Power Trading operates on an STP-ECN trading model, ensuring fair and transparent order execution by directly connecting trades to international markets. This approach aims to eliminate delays and re-quotes, facilitating instant trade execution with 100% automatic price matching, thus preventing third-party intervention.

The platform offers two types of accounts: STP and ECN. STP accounts feature floating spreads, with the minimum spread for major currency pairs starting at 1.9 pips. In contrast, ECN accounts offer zero spreads for major currency pairs, allowing traders to benefit from direct market access with tighter spreads. However, ECN accounts typically require higher minimum deposits and may involve commission fees based on trade volume or a flat fee per trade.

Trading Platform

Power Trading exclusively utilizes the MetaTrader 4 (MT4) platform, renowned for its reliability and extensive suite of trading tools. MT4 offers a user-friendly interface combined with advanced charting capabilities, making it a preferred choice among traders worldwide. With MT4, Power Trading clients gain access to a vast array of technical indicators, customizable chart templates, and real-time market data, enabling them to conduct in-depth market analysis and make informed trading decisions.

The platform's versatility extends to automated trading through Expert Advisors (EAs), allowing traders to implement algorithmic strategies and execute trades automatically based on predefined parameters. Moreover, MT4's mobile compatibility ensures traders can stay connected to the markets and manage their trades on-the-go, providing flexibility and convenience.

Q&A

Is Power Trading regulated?

Yes, it is regulated by the Australia Securities & Investment Commission (ASIC).

What are the minimum deposit requirements for opening an account with Power Trading?

100 USD.

Are MT4 and MT5 trading platforms available at Power Trading?

Yes. It supports MT4.

How can I contact Power Trading?

You can reach out to Power Trading via email: admin@powertradingltd.com.

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now