Score

Driss IFC

United States|Within 1 year|

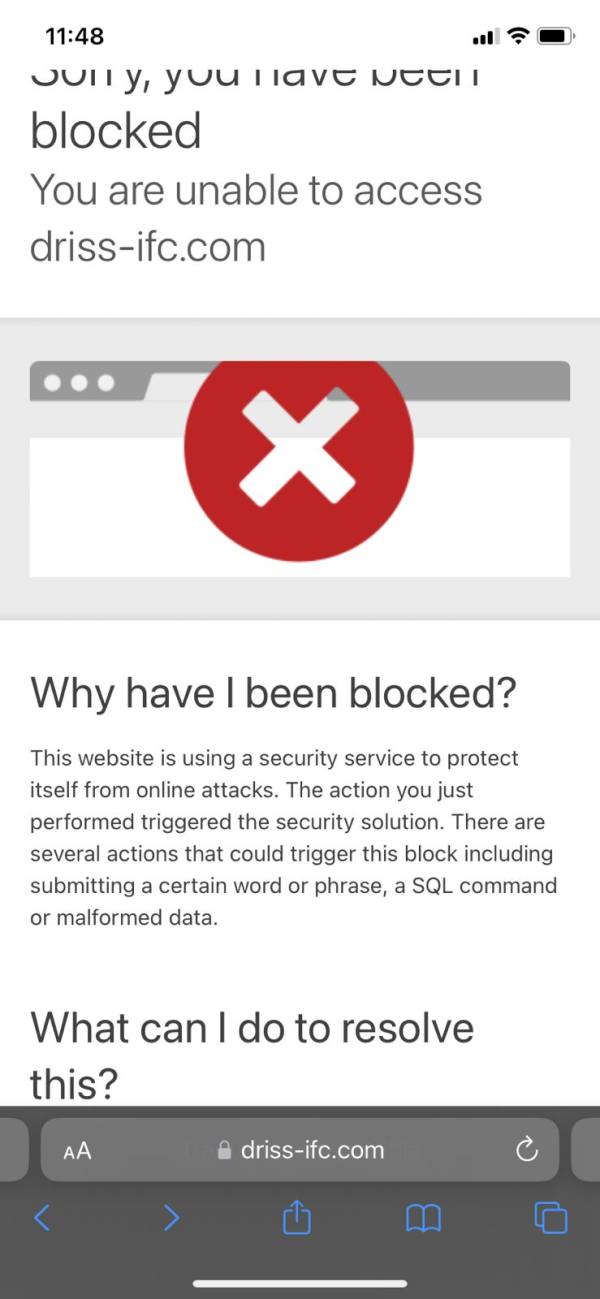

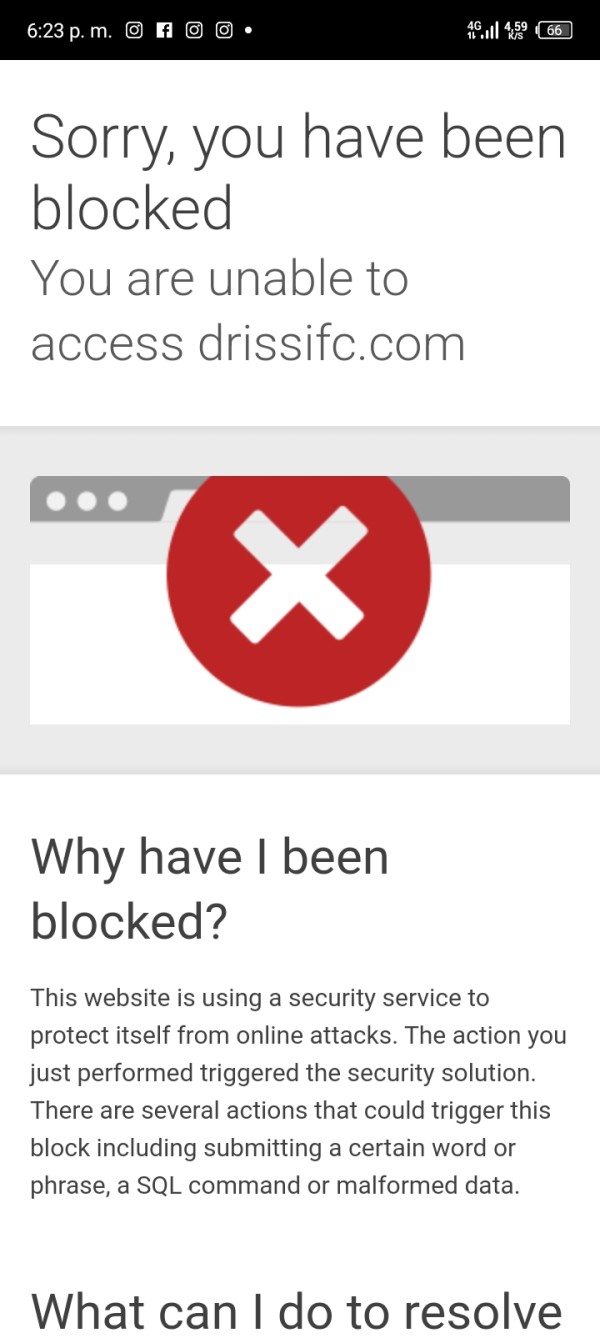

United States|Within 1 year| https://driss-ifc.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

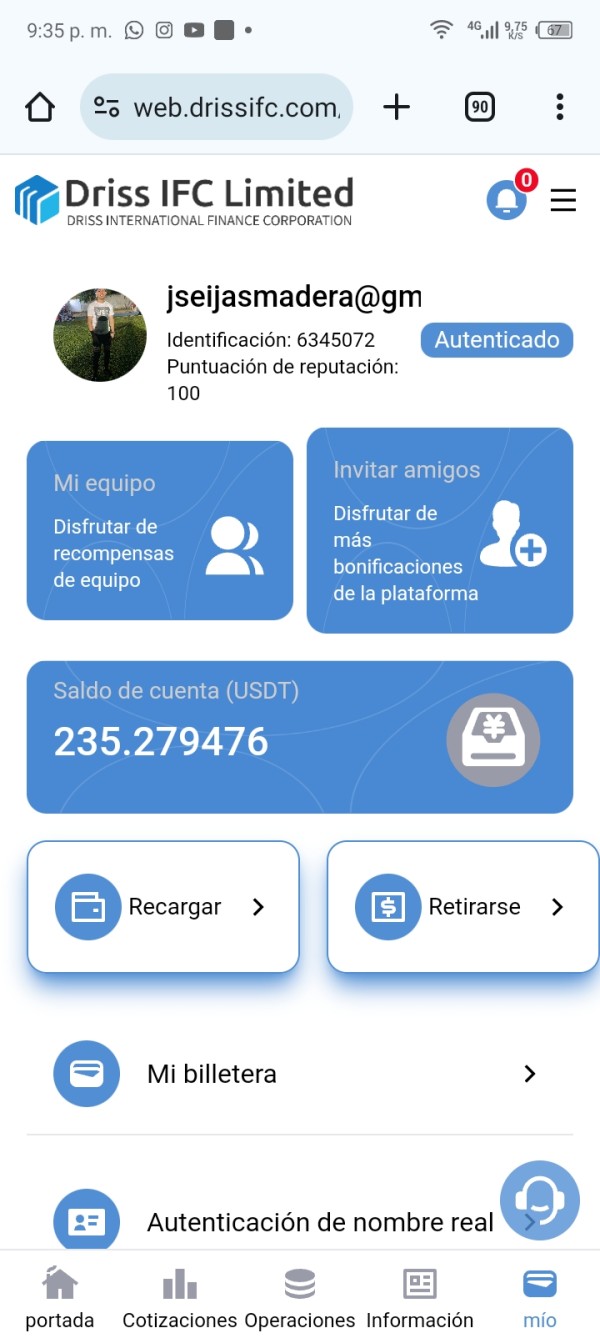

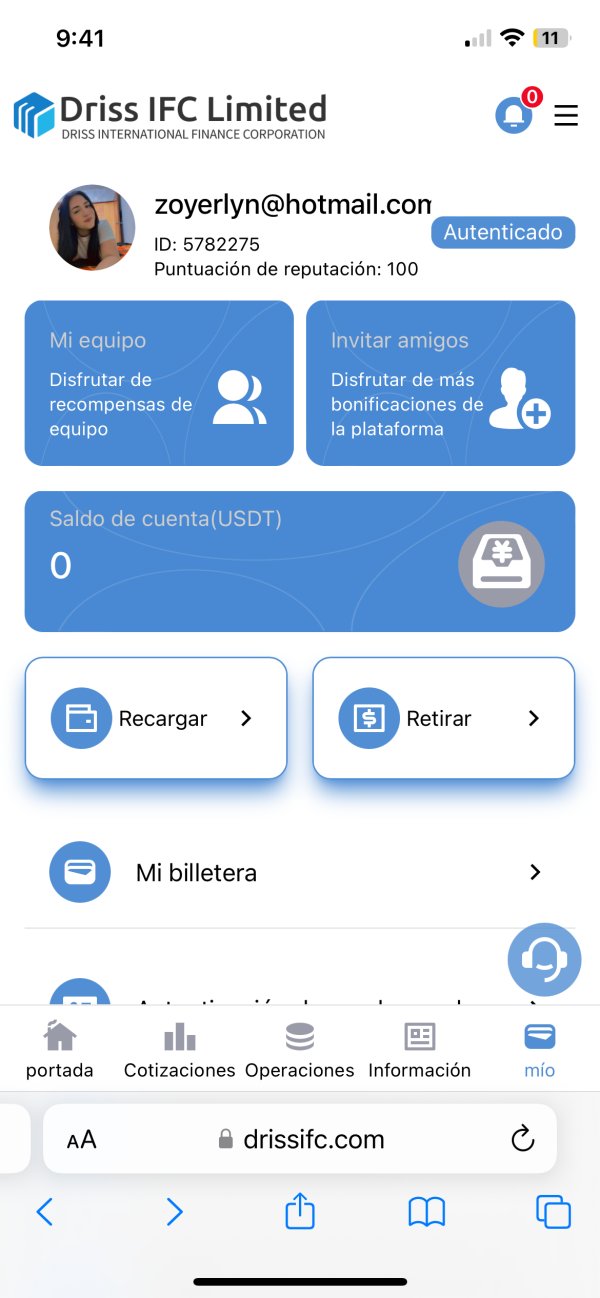

Driss IFC Limited

Driss IFC

United States

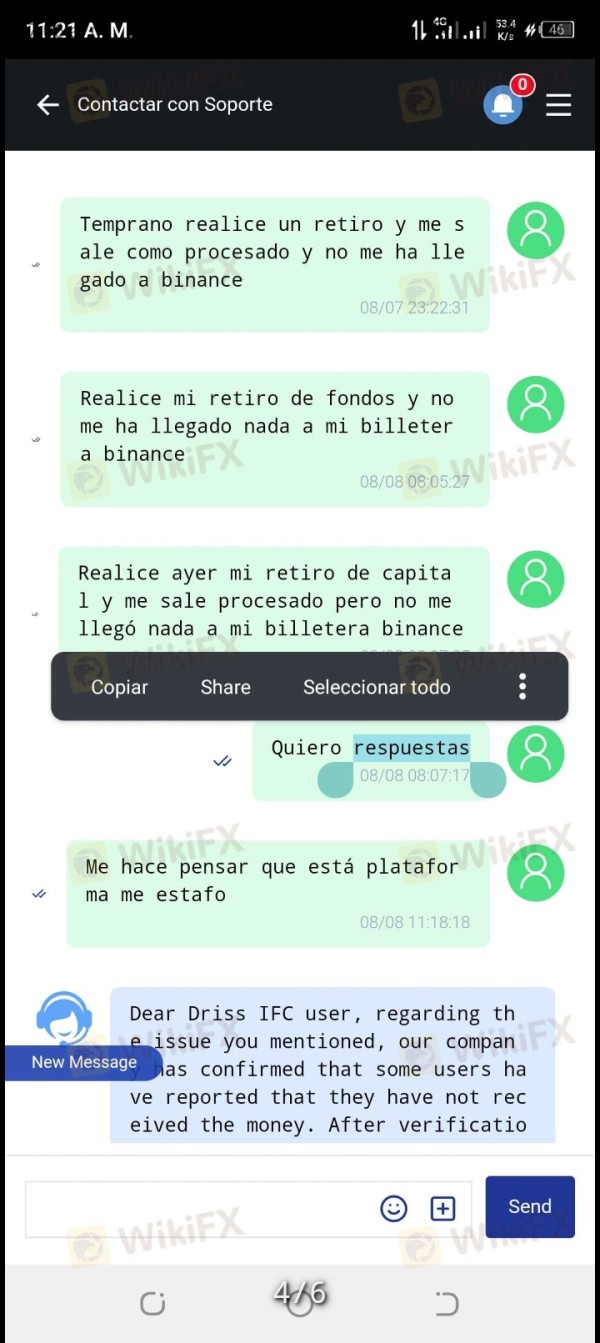

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

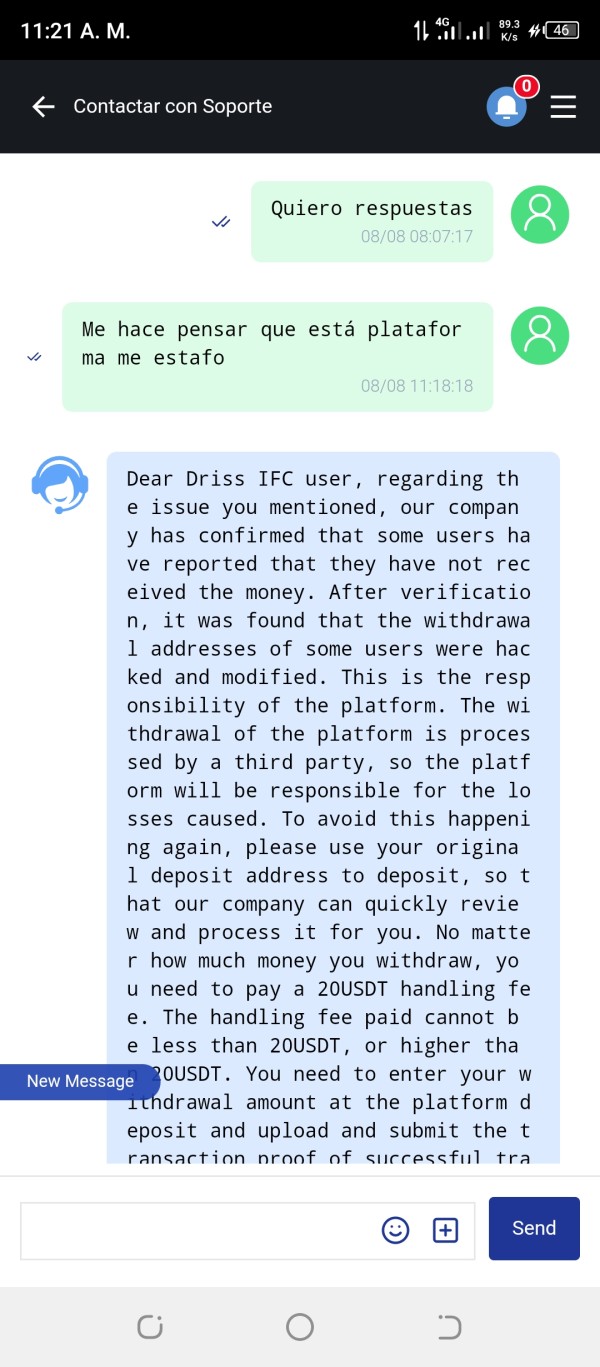

- The number of the complaints received by WikiFX have reached 13 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The current information shows that this broker does not have a trading software. Please be aware!

WikiFX Verification

Users who viewed Driss IFC also viewed..

XM

IronFX

KCM Trade

FP Markets

Driss IFC · Company Summary

| Driss IFC | Basic Information |

| Founded in | 2024 |

| Registered in | United States |

| Regulation | FinCEN |

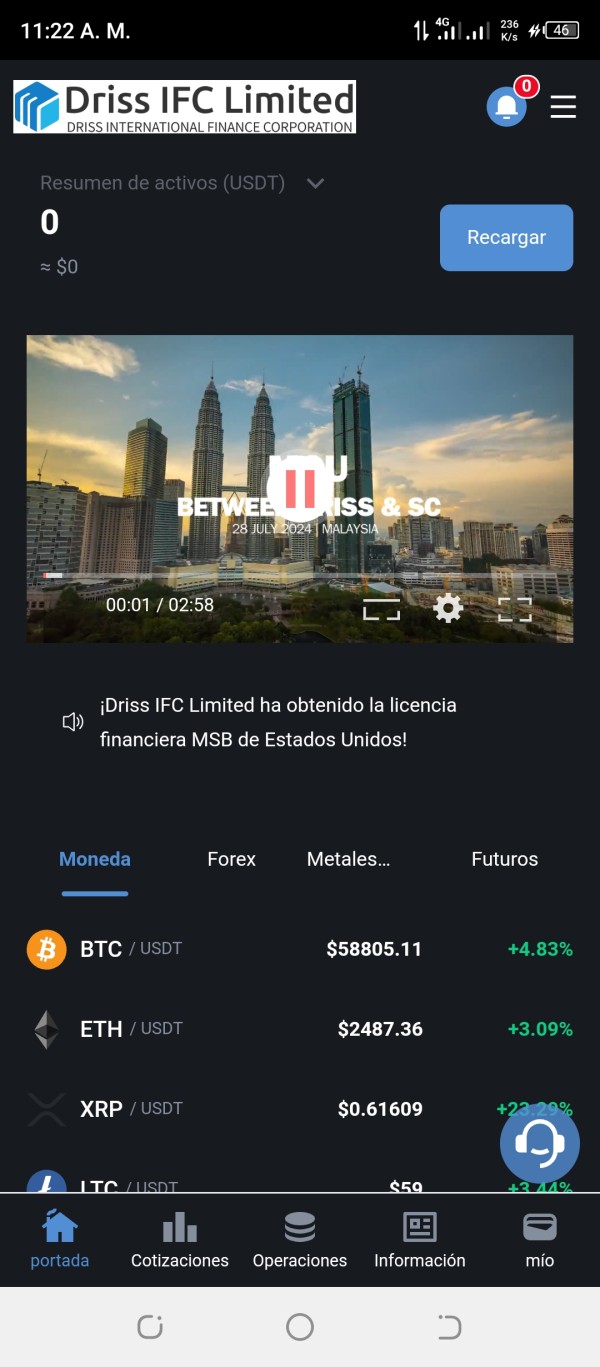

| Tradable Assets | Cryptos, Forex, Precious Metals, Futures |

| Trading Platform | Trading App |

| Customer Support | Online Chat |

| Promotions | Yes |

Driss IFC Information

Driss IFC is a newly established brokerage firm founded in 2024 and registered in the United States. The company offers trading in cryptocurrencies, forex, precious metals, and futures through a proprietary trading app.

Is Driss IFC Legit?

Driss IFC is regulated in the United States, authorized by the Financial Crimes Enforcement Network (FinCEN). It holds a Crypto license under license no.31000274201881.

Pros and Cons

| Pros | Cons |

|

|

|

|

| |

|

Pros:

- 350 tradable cryptocurrencies supported: Driss IFC provides access to 350 tradable cryptocurrencies, offering traders a wide range of options in the digital asset space.

- Up to 3 USDT Reward for Certified users: The broker offers a reward of up to 3 USDT for certified users, which could be attractive for new clients.

- Online chat support : Online chat support is available, enabling quick assistance for traders.

- Website available in 10 languages: Driss IFC is available in 10 languages, making it accessible to a global audience.

Cons:

- Trading fees not disclosed: The broker does not disclose its trading fees, making it difficult for potential clients to assess the cost-effectiveness of their services.

- No payment methods: The absence of clear payment methods could pose challenges for fund deposits and withdrawals.

Tradable Assets

Driss IFC offers four classes of tradable assets in total, with a particular focus on cryptocurrencies. The broker provides access to an impressive selection of 350 digital currencies, available for trading across spot, futures, and USDT-margined markets. In addition to its robust crypto selection, Driss IFC extends its asset portfolio to include traditional financial instruments such as forex pairs and precious metals, as well as futures contracts.

Trading Platform

Driss IFC provides a streamlined trading experience through its proprietary trading app, accessible via both web-based and downloadable versions.

Customer Support

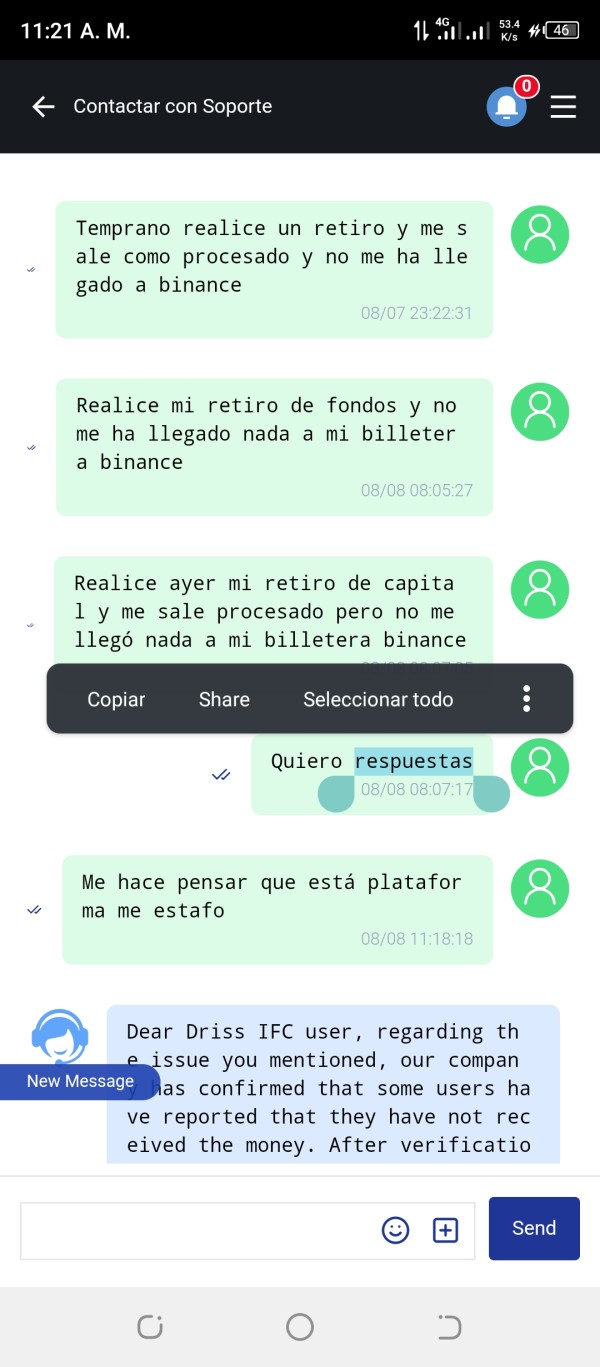

For customer support, Driss IFC relies exclusively on an online chat feature, offering real-time assistance to traders. However, the absence of additional contact methods such as phone or email support may limit communication options for users who prefer alternative channels.

Conclusion

In summary, Driss IFC shines with its impressive array of 350 tradable cryptocurrencies and a website that caters to a global audience in 10 languages. These features make it an attractive option for crypto enthusiasts and international traders. However, the glaring absence of regulatory oversight casts a long shadow over the broker's operations, raising serious concerns about trader safety and fund security.

Given its high-risk profile, Driss IFC might appeal to seasoned traders who are well-versed in the crypto market and comfortable navigating unregulated waters. It could be a playground for those seeking a wide variety of digital assets and who have the experience to manage the associated risks. On the flip side, it's definitely not the place for cautious investors or anyone looking for the safety net that comes with regulatory compliance. If you're new to trading or prefer a more secure environment, you'd be better off looking elsewhere.

FAQs:

Is Driss IFC legit?

Driss operates legally and it is regulated FinCEN in the United States.

Is Driss IFC safe to trade?

The safety of trading with Driss IFC cannot be guaranteed, as online trading always involves many risks.

Is Driss IFC good for beginners?

For beginners, Driss IFC is not a good choice. Specifically, beginners may find it less suited because of insufficient regulation, a lack of educational content, and limited customer support options.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then.

Review 15

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now