Score

Fidelis CM

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://www.fideliscm.com

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

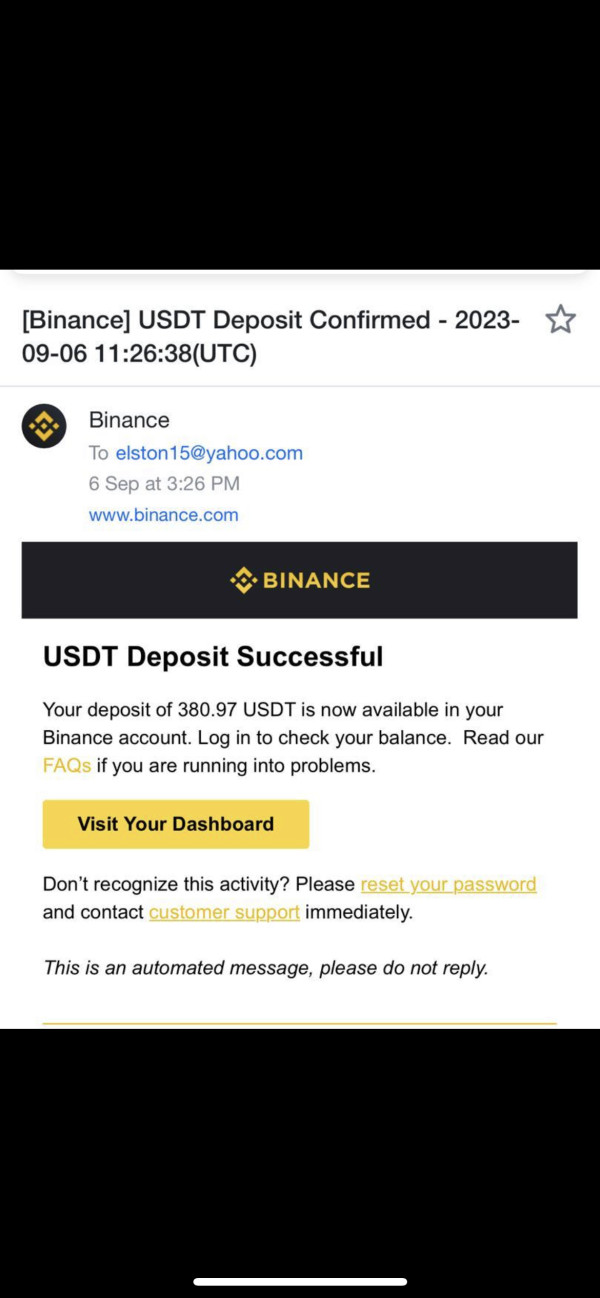

FidelisCapitalMarkets-LIVE

India

IndiaInfluence

C

Influence index NO.1

Dominica 3.56

Dominica 3.56MT4/5 Identification

MT4/5 Identification

Full License

India

IndiaInfluence

Influence

C

Influence index NO.1

Dominica 3.56

Dominica 3.56Surpassed 80.32% brokers

Contact

Licenses

Single Core

1G

40G

Disclosure

Danger

Contact number

+65 31635717

+60 392121910

+971 4 353 8803

Other ways of contact

Broker Information

More

Fidelis CAPITAL MARKETS

Fidelis CM

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- VanuatuVFSC (license number: 14841) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

- The CyprusCYSEC regulation (license number: 208/13) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The Vanuatu VFSC regulation with license number: 14841 is an offshore regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 4 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:200 |

| Minimum Deposit | USD 50000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (3+) Bank transfer VISA Skrill |

| Withdrawal Method | (3+) VISA Bank transfer Skrill |

| Commission | $ 1.25 FX $ 1.25 Metals $ 1.25 CFD’s |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | USD 5000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (3+) Bank transfer VISA Skrill |

| Withdrawal Method | (3+) VISA Bank transfer Skrill |

| Commission | $ 2.5 FX $ 4 Metals $ 4 CFD’s |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | USD 1000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (3+) Skrill Bank transfer VISA |

| Withdrawal Method | (3+) VISA Bank transfer Skrill |

| Commission | $ 3 FX $ 4.5 Metals $ 4.5 CFD’s |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | USD 500 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (3+) Skrill Bank transfer VISA |

| Withdrawal Method | (3+) VISA Bank transfer Skrill |

| Commission | $ 0 FX $ 0 Gold, $ 7.5 Silver $ 7.5 CFD’s |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | USD 100 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | (3+) Bank transfer VISA Skrill |

| Withdrawal Method | (3+) Bank transfer Skrill VISA |

| Commission | $ 0 FX $ 0 Metals $ 12.5 CFD's |

VISA

| Minimum withdrawal | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| Withdrawal Not Allow | none | -- | none | USD |

Skrill

| Minimum withdrawal | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| No limit | none | -- | Within the day | USD |

Bank transfer

| Minimum withdrawal | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| No limit | Only bank fees | -- | 3-5 working days depending on bank | USD |

Bank transfer

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| $ 5 | Deposits over $5,000 no fee Below $ 5,000 bank fees depending on bank | -- | Once funds hit our bank account | USD |

Skrill

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| $ 5 | none | -- | Within the day | USD |

VISA

| Minimum Deposit | Commission | Exchange rate | Processing time | Currency unit |

|---|---|---|---|---|

| $ 5 | Fees Depending on Bank | -- | 1 working days | USD |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Fidelis CM also viewed..

XM

FP Markets

Decode Global

FXCM

Sources

Language

Mkt. Analysis

Creatives

Fidelis CM · Company Summary

| Aspect | Information |

| Registered Country/ Area | Saint Vincent and the Grenadines |

| Founded Year | 2011 |

| Company Name | Fidelis Capital Markets |

| Regulation | Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number GB19024708 and Fidelis Capital Markets Limited registered by FSA, St. Vincent and the Grenadines with Number 24163 IBC 2017 |

| Minimum Deposit | $100 - $5000 |

| Maximum Leverage | 1:200 - 1:400 |

| Spreads | From 0.0 pips |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Precious Metals, CFDs, and Cryptocurrencies |

| Account Types | Rookie/Pro, Prime/ECN Pro, Unique/VIP |

| Demo Account | Yes |

| Islamic Account | Yes |

| Customer Support | Phone, Email |

| Deposit Methods | Bank transfer, credit/debit card, e-wallets |

| Withdrawal Methods | Bank transfer, credit/debit card, e-wallets |

| Educational Tools | Video tutorials, trading guides, market analysis |

Overview of Fidelis CM

Fidelis Capital Markets (Fidelis CM) is an online forex and CFDs broker offering trading services to traders worldwide. The company is regulated by the Financial Services Commission of the Republic of Mauritius and registered with the FSA of St. Vincent and the Grenadines.

Fidelis CM offers a variety of trading instruments including forex, precious metals, CFDs, and cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Ripple, and more. Traders can access these markets through the popular MetaTrader MT4 and MT5 trading platforms.

The broker provides five trading account types with different minimum deposit requirements, spreads, and commission rates. The accounts also offer leverage up to 1:400, with the exception of the Unique Account that has a leverage of 1:200. Trade sizes range from 0.01 lots up to 100 lots. Unfortunately, information about the spreads is not readily available on the website, but it is known that they are variable and move with the markets.

Fidelis CM offers a variety of deposit and withdrawal options such as wire transfers, credit cards, and e-wallet systems such as Skrill, Neteller, Webmoney, and more. The broker prides itself on providing excellent customer service, and clients can contact the support team via phone or email.

Pros and Cons

| Pros | Cons |

| Offers a variety of payment options for deposits and withdrawals | Not available to residents of certain jurisdictions such as the USA and British Columbia |

| Multiple account types with varying features | Limited range of tradable assets compared to some other brokers |

| Good selection of educational resources | Relatively high minimum deposit requirements for some account types |

Is Fidelis CM Legit or a Scam?

Fidelis CM appears to be a legitimate company that provides investment and ancillary services, as it is registered with the Financial Services Authority (FSA) in Saint Vincent and the Grenadines with the registration number 24163 IBC 2017. Additionally, Fidelis Capital International Markets is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number GB19024708. The company also claims to use reputable banks to deposit client funds, and to have strict compliance checks for AML/MLTPA regulations. However, it's important to note that investing always carries risks and it's advisable to conduct due diligence before making any investment decisions.

Market Instruments

Fidelis CM offers a range of market instruments for traders to invest in, including forex, currencies, CFDs, and precious metals like gold and silver.

Forex:

With Fidelis CM, traders can invest in 62 currency pairs and benefit from superior professional services and instant order execution. The company provides a modern, safe, and technology-driven trading environment backed by some of the best liquidity providers in the industry. Take control of your forex investments and enjoy the best risk-reward opportunities of the financial markets with an award-winning forex brokerage firm.

Currencies:

Fidelis CM offers a variety of currency trading options, with 10 symbols available for traders to choose from. Each currency type comes with a PIP value, standard lot size, limit and stop levels, and swap long/short values. This allows traders to tailor their investment strategy to their specific needs and preferences.

CFDs:

Fidelis CM provides a wide selection of CFD trading instruments on shares, indices, commodities, and ETFs. Traders can benefit from unmatched pricing, earn dividends, and enjoy brilliantly fast execution with state-of-the-art technology. Fidelis CM also allows for freedom of deposits and withdrawals, with no additional fees or commissions on trades. There are no limits on day trading, and traders can start with as little as $100 for CFD trading in shares, indices, and commodities.

Precious Metals:

Investing in precious metals like gold and silver can act as a hedge against market fluctuations, economic downturns, and political unrest. Fidelis CM offers a way for traders to invest in these assets through exchange-traded contracts that offer short-term investment opportunities. These contracts offer a simpler, less capital-intensive way of benefiting from price movements in gold and silver for traders. Fidelis CM also offers lower transaction costs, daily market analysis, and multiple trading account options to choose from.

| Market Instrument | Pros | Cons |

| Forex | Superior service and instant order execution, 62 currency pairs available, best risk-reward opportunities | High risk due to volatility, requires significant knowledge and skill |

| Currencies | Wide selection of trading instruments, unmatched pricing, ability to earn dividends, fast execution, freedom of deposits and withdrawals | Risk of market fluctuations and economic downturns, potential for losses |

| Precious Metals | Hedging against uncertainty in the markets, simpler and less capital-intensive than physical ownership, short-term investment opportunities | Limited potential for profit, requires understanding of socio-political factors |

| CFDs | Wide selection of trading instruments, commission-free trading, daily market analysis, multiple trading account options | High risk, potential for significant losses, requires significant knowledge and skill |

Spreads & Commissions

Fidelis CM offers spreads and commissions to its clients across various financial instruments. The exact spreads and commissions depend on the type of account you have and the instrument you are trading. Here are some general points to keep in mind:

Spreads:

Forex spreads start from as low as 0.0 pips for major currency pairs like EUR/USD, USD/JPY, and GBP/USD.

Spreads for other instruments like commodities, indices, and cryptocurrencies vary depending on the specific asset and market conditions.

Spreads are generally lower for higher account tiers.

Commissions:

Fidelis CM charges commission on certain account types like the Raw Spread account, which offers lower spreads in exchange for a fixed commission per lot traded.

Commission rates vary depending on the account type, instrument, and lot size.

The commission is charged in the base currency of the instrument being traded.

It is always important to carefully review the specific spreads and commissions for the instrument and account type you are interested in before opening a position.

| Pros | Cons |

| Lower Spreads: Fidelis CM offers lower spreads for higher account tiers, which can potentially lead to reduced trading costs and improved profitability for traders. | No fixed spreads: Fidelis CM does not offer fixed spreads, which means the spread can widen during times of market volatility, potentially leading to higher transaction costs. |

| 1. Base Currency Commission: The commission charged by Fidelis CM is in the base currency of the instrument being traded. This simplifies the calculation and ensures consistency in understanding the actual commission costs for each trade. | Higher commissions for smaller accounts: Fidelis CM charges higher commissions for smaller accounts, which may make it less accessible for traders with limited capital.Limited account options: Fidelis CM offers a limited number of account types, which may not be suitable for all types of traders. |

| Pre-Trade Evaluation: It is emphasized to carefully review the specific spreads and commissions for the instrument and account type of interest before opening a position. This pre-trade evaluation allows traders to assess the costs upfront and make well-informed decisions, avoiding any surprises or hidden charges during trading. |

Account Types

Fidelis CM offers five different account types: Mini/MSX, Rookie/Pro, Prime/ECN Pro, Elite/Unique, and VIP. Here's a brief overview of the features of each account:

1. Mini/MSX: This account type has a minimum deposit balance of $100 and a maximum leverage of up to 1:400. The standard lot size ranges from 0.01 to 100, and the account currency is in USD. Order execution is ECN/STP, and trade executions are under 100ms. There are no trade fees, and the commissions per side for 100,000 traded vary from $0 for FX to $12.5 for CFDs.

2. Rookie/Pro: This account type has a minimum deposit balance of $500 and a maximum leverage of up to 1:400. The standard lot size ranges from 0.01 to 100, and the account currency is in USD. Order execution is ECN/STP, and trade executions are under 100ms. There are no trade fees, and the commissions per side for 100,000 traded vary from $0 for FX and Gold to $7.5 for Silver and CFDs.

3. Prime/ECN Pro: This account type has a minimum deposit balance of $1000 and a maximum leverage of up to 1:400. The standard lot size ranges from 0.01 to 100, and the account currency is in USD. Order execution is ECN/STP, and trade executions are under 100ms. The commissions per side for 100,000 traded vary from $3 for FX to $4.5 for Metals and CFDs.

4. Elite/Unique: This account type has a minimum deposit balance of $5000 and a maximum leverage of up to 1:400. The standard lot size ranges from 0.01 to 100, and the account currency is in USD. Order execution is ECN/STP, and trade executions are under 100ms. The commissions per side for 100,000 traded vary from $2.5 for FX to $4 for Metals and $4 for CFDs.

5. VIP: This account type has a minimum deposit balance of $50000 and a maximum leverage of up to 1:200. The standard lot size ranges from 0.01 to 100, and the account currency is in USD. Order execution is ECN/STP, and trade executions are under 100ms. The commissions per side for 100,000 traded vary from $1.25 for FX, Metals, and CFDs.

All account types offer Islamic accounts as an option and allow for scalping and hedging. Clients can choose from a variety of platforms, including Meta Trader 4, MT4 Mobile, MT4 iMac, Meta Trader 5, MT5 Mobile, and MT5 iMac. Fidelis CM also offers free signals, news trading, and free training to all account holders.

| Account Type | Pros | Cons |

| MINI/MSX | No maximum deposit limit, high leverage, various trading platforms available | Limited commission-free trading, smaller range of features compared to higher-tier accounts |

| ROOKIE/Pro | High leverage, various trading platforms available | Higher minimum deposit compared to MINI/MSX account, smaller range of features compared to higher-tier accounts |

| PRIME/ECN Pro | Lower commissions, faster trade execution, more features available | Higher minimum deposit compared to lower-tier accounts, higher trade fees, lower maximum leverage compared to lower-tier accounts |

| ELITE/Unique/VIP | Lower commissions, faster trade execution, more features available, personal account manager | Highest minimum deposit, highest trade fees, lower maximum leverage compared to lower-tier accounts |

Deposit & Withdrawal

At Fidelis Capital Market, depositing, transferring, and withdrawing funds from your trading account is easy and hassle-free. We provide our traders with a variety of payment methods to choose from, allowing you to use the payment option most convenient for you.

Our zero withdrawal fees policy means that you can withdraw your funds without incurring any fees from us. However, please note that your bank or credit card company may charge you a fee for the transaction.

To deposit funds, simply choose your preferred payment option, and transfer the funds to your trading account. We accept deposits starting from $5, and deposits over $5,000 are included in our zero fees policy. If your deposit is below $5,000, any bank fees will depend on your bank.

Once your funds hit our bank account, they will be credited to your trading account within 3-5 working days, depending on your bank.

To withdraw funds, go to the Withdrawal section of your Client Cabinet, choose your preferred payment method, and follow the steps. Please note that withdrawals are only allowed to the same payment method used for deposits. If your withdrawal is below the minimum amount, fees may apply depending on your bank.

Withdrawals are usually processed within 1 working day, but please allow additional processing time for your bank or credit card company to complete the transaction.

At Fidelis Capital Market, we take the security of our clients' payment information seriously. We use Transport Layer encryption – TLS 1.2 and application layer with algorithm AES and key length 256 bit to protect customer card details.

| Pros | Cons |

| Zero withdrawal fees policy | Bank fees for deposits below $5,000 |

| No deposit fees for deposits over $5,000 | Withdrawals not allowed for certain currencies |

| Payment card details are protected using TLS 1.2 | Withdrawal processing time not specified for some |

| Fast deposit processing time | currencies |

| Various payment options available | Commission on deposit depends on payment method |

| No minimum withdrawal limit | Withdrawal commission depends on payment method |

| Withdrawals processed within 1 working day |

Trading Platforms

Fidelis CM offers two trading platforms, MetaTrader 5 (MT5) and MetaTrader 4 (MT4), which provide traders with the necessary tools and resources to analyze price developments and trends of financial instruments and take investment decisions. The Fidelis MT5 platform offers direct market access, low spreads starting from 0.0 pips on EURUSD, and millisecond execution. It supports STP accounts, micro-lots, and allows for EA, scalping, and hedging. The platform is available for Windows and mobile devices powered by iOS and Android. Similarly, the Fidelis MT4 platform also provides direct market access, low spreads starting from 0.0 pips on EURUSD, and millisecond execution. It supports STP accounts, micro-lots, and allows for EA, scalping, and hedging. The MT4 platform is available for Mac OSX and mobile devices powered by iOS and Android. Both platforms offer live quotes, real-time charts, in-depth news and analysis, and over 100 instruments, including Forex, CFDs, Futures, Metals, and indices. They also feature more than 50 built-in indicators to help measure trading patterns and discover entry and exit points.

| Pros | Cons |

| 1. Multiple Trading Platforms: Fidelis offers various trading platforms including MetaTrader 4, MetaTrader 5, and cTrader. | 1. Limited Tradable Assets: The range of tradable assets offered by Fidelis is relatively small compared to some other brokers. |

| 2. Competitive Spreads: Fidelis offers competitive spreads that are often lower than those of many other brokers. | 2. Limited Payment Methods: Fidelis offers a limited range of payment methods, which may not be suitable for some traders. |

| 3. Fast Execution: Fidelis claims to offer fast execution speeds, which can be important for traders who want to enter and exit positions quickly. | 3. Limited Educational Resources: Fidelis does not offer a lot of educational resources for beginner traders. |

| 4. No Hidden Fees: Fidelis is transparent about its fees and charges no hidden fees, which can be reassuring for traders. | 4. No US Clients: Fidelis does not accept clients from the United States, which may be a downside for some traders. |

| 5. 24/7 Customer Support: Fidelis offers customer support around the clock, which can be useful for traders who need assistance outside of regular business hours. | 5. No Negative Balance Protection: Fidelis does not offer negative balance protection, which means that traders can potentially lose more than their account balance. |

Educational Resources

Fidelis CM provides a range of educational resources and courses to help traders learn about Forex trading, market analysis, and the MetaTrader platform. For beginners, there are courses on Forex trading and a beginner's course on the MetaTrader platform. For more advanced traders, there are courses on technical indicators, stock trading, and CFDs.

In addition, Fidelis CM has partnered with Trading Central, a leading market analysis firm, to provide traders with insights on market direction using graphical analysis, mathematical indicators, and candlestick analysis. Trading Central also offers an MT4 indicator plugin that provides traders with technical analysis in multiple languages and customizable parameters. Overall, Fidelis CM's trading platforms and educational resources appear to be comprehensive and designed to support traders of all skill levels.

| Pros | Cons |

| Comprehensive courses on Forex trading, market analysis, and the MetaTrader platform | No advanced courses on stocks or other financial instruments |

| Beginner and advanced courses available | Limited course options compared to some competitors |

| Trading Central analysis and MT4 indicator plugin available for technical analysis | Limited focus on fundamental analysis |

| Partnership with Trading Central, a leading market analysis provider | No free demo account for practicing trading strategies |

| Educational resources available in multiple languages | No live trading webinars or mentorship programs |

It's important to note that these pros and cons are based on the current state of Fidelis CM's educational resources and may change in the future. Additionally, the specific needs and preferences of each individual trader will vary, so it's important to consider these factors when evaluating the suitability of Fidelis CM's educational resources for your own trading goals.

Customer Service

Fidelis CM is committed to providing high-quality customer service to its clients. The company has a team of experienced and knowledgeable customer support professionals who are available 24/5 to assist clients with any questions or concerns they may have.

Clients can reach the customer support team via email, phone, or live chat. The company also provides multilingual support in several languages including English, Spanish, Arabic, and Chinese. Additionally, Fidelis CM provides a comprehensive FAQ section on their website, which covers a wide range of topics related to trading, account opening, funding and withdrawal, and other general queries.

The company also offers a personal account manager to clients who require more personalized support. The account manager assists clients with setting up their accounts, funding and withdrawals, and provides support with any trading-related queries.

Overall, the customer service provided by Fidelis CM is professional, responsive, and efficient, ensuring that clients receive the support they need to trade with confidence.

Conclusion:

In conclusion, Fidelis Capital Markets stands out as a legitimate and reliable broker, providing a diverse range of trading services and user-friendly platforms. The company's regulatory status under CySEC and the inclusion of negative balance protection offer added assurance regarding fund safety. Additionally, Fidelis CM's comprehensive educational resources make it an attractive choice for traders at various skill levels. However, it remains crucial for prospective clients to conduct their own research and due diligence before committing to an account with Fidelis CM or any other brokerage firm, ensuring alignment with individual trading needs and preferences.

Frequently Asked Questions

1. Q: How do I get started with trading on Fidelis CM? Is it necessary to download software to begin?

A: If you've completed the process of opening a trading account, received your login credentials via email, submitted your identification documents for account validation, and deposited funds, the next step is to download the MT4 trading platform.

2. Q: What types of trading accounts are offered by Fidelis CM?

A: Fidelis Capital Markets offers 10 different types of trading accounts, including Rookie/Pro, Prime/ECN Pro, Unique/VIP, and others, subject to regulations. For more information, visit the Account Types page.

3. Q: What kind of identification proof is required?

A: Valid photo identification such as a passport copy, driver's license copy, or government ID card is required.

4. Q: What should I do if I don't have a utility bill in my name?

A: If you do not have a utility bill in your name, you can provide an official, stamped bank letter, lawyer's letter, or municipality letter indicating your name and residential address.

5. Q: What happens if I forget or lose my password?

A: If you forget or lose your password, you can click on “forgot password” on the login home page, and a new password will be automatically sent to your email address for security purposes. Alternatively, you can contact Fidelis CM via phone, live chat, or email at backoffice@fideliscm.com for assistance.

6. Q: What is the minimum deposit amount for a trading account?

A: For a Live account, the minimum deposit is USD 100 (for Mini account type ONLY). For information on all account types and their minimum balances, visit the Account Types page.

7. Q: How can I deposit or withdraw funds from my trading account?

A: To deposit or withdraw funds, log into the Members Area on the Fidelis CM website and select the Deposit/Withdrawal options.

8. Q: How long does it typically take for bank wire deposits to be processed?

A: Bank wire deposits usually take 3-5 business days to process, depending on the intermediary bank.

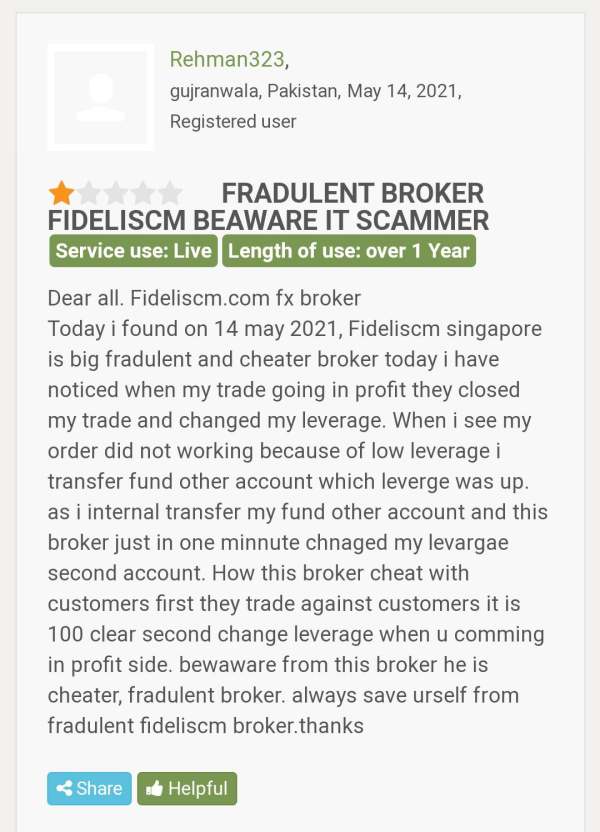

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now