Score

TRI

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.triltasia.com/en/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

Tri-Demo

United States

United StatesInfluence

D

Influence index NO.1

Singapore 2.46

Singapore 2.46MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesInfluence

Influence

D

Influence index NO.1

Singapore 2.46

Singapore 2.46Surpassed 100.00% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+35722030913

+357 22030913

Other ways of contact

Broker Information

More

Tri Group

TRI

United Kingdom

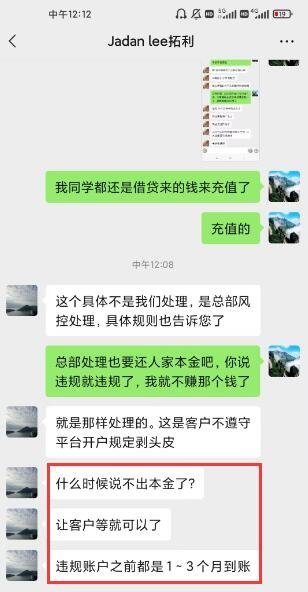

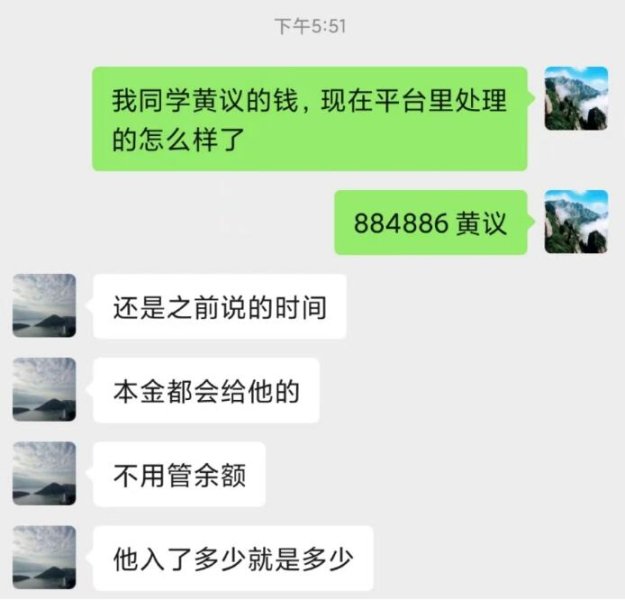

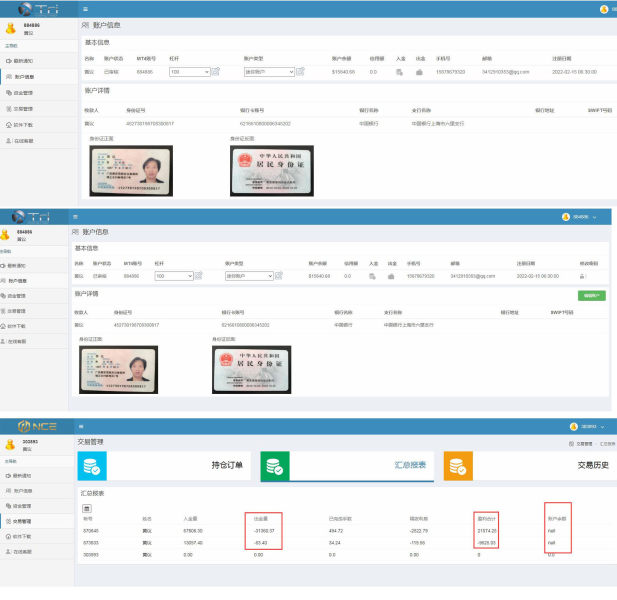

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 112 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- GermanyBaFin (license number: 148055) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

- This broker exceeds the business scope regulated by Germany BaFin(license number: 148055)BaFin Non-Forex Licence Non-Forex License. Please be aware of the risk!

- The United KingdomFCA regulation (license number: 750779) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The CyprusCYSEC regulation (license number: 254/14) claimed by this broker is suspected to be clone. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $100000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $50000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $25000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $5000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $250 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed TRI also viewed..

XM

KCM Trade

VT Markets

GO MARKETS

Total Margin Trend

- VPS Region

- User

- Products

- Closing time

HoChiMinh

HoChiMinh- 359***

- CL.Exp

- 07-01 16:30:38

Seoul

Seoul- 634***

- CL.Exp

- 07-01 16:17:27

Hongkong

Hongkong- 690***

- CL.Exp

- 07-01 16:09:29

Stop Out

0.78%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

TRI · Company Summary

| Tri Group | Basic Information |

| Registered Country/Region | United Kingdom |

| Founded in | 2018 |

| Regulation | No |

| Minimum Deposit | $100 |

| Max. Leverage | Up to 1:500 |

| Minimum Spreads | From 1.2 pips |

| Account Types | Standard, Pro, ECN |

| Trading Platforms | MetaTrader 4 |

| Payment Methods | Credit/debit cards, bank transfer, e-wallets |

| Customer Support | Phone, email, live chat, social media |

Overview of TRI

Tri Group is a UK-based forex and CFD broker, founded in 2018. The company offers trading services in a wide range of financial instruments, including forex, commodities, indices, and stocks, with a maximum leverage of up to 1:500. The minimum deposit required to open a trading account with Tri Group is $100, and the broker provides its clients with access to the MetaTrader 4 trading platform, a popular and reliable trading platform in the industry. In addition, Tri Group offers several account types to cater to the different needs of traders, and provides various payment methods for deposit and withdrawal.

Is TRI Legit or a Scam?

The fact that TRI is not regulated by a reputable financial authority may raise some concerns about its safety and reliability as a broker.

When considering whether or not to trade with TRI, it's important to do your own research and due diligence. Look for information about the broker's history, reputation, and any customer reviews or complaints. You may also want to consider the broker's trading conditions, such as spreads, commissions, and leverage, to see if they are competitive and transparent.

Ultimately, the decision to trade with TRI or any other broker is up to you, and should be based on your own personal preferences and risk tolerance. If you do choose to trade with an unregulated broker like TRI, it's important to be aware of the risks and take steps to protect yourself, such as only depositing small amounts of money, using a reputable payment method, and closely monitoring your account activity.

Pros & Cons of TRI

As with any broker, there are both pros and cons to using TRIs trading services.

On the positive side, TRI offers a variety of account types, including Standard, Pro, and ECN, to accommodate different trading styles and experience levels. They also provide clients with a choice of trading platforms, including the popular MetaTrader 4 and 5. TRI's customer support is available 24/5 and can be accessed via phone, email, or live chat.

On the negative side, TRI has received numerous complaints regarding their services, particularly in relation to withdrawal issues and high fees. Their spreads and commissions are also comparatively high when compared to other brokers. Additionally, TRI is not regulated by any well-known financial authority, which may be a cause for concern for some traders.

| Pros | Cons |

| Competitive spreads | Limited regulatory oversight |

| Multiple account types | High minimum deposit requirements |

| Wide range of trading instruments | Expensive non-trading fees |

| User-friendly trading platforms | Significant number of client complaints |

| Variety of payment options | Lack of transparency in certain areas |

Market Instruments

TRI offers a variety of trading instruments across different markets, including Forex currency pairs, commodities, indices, and cryptocurrencies. Traders can access over 60 currency pairs, including major, minor, and exotic pairs, as well as popular commodities such as gold, silver, and oil. TRI also offers trading on several stock indices, such as the S&P 500 and FTSE 100, and several cryptocurrencies including Bitcoin, Ethereum, and Litecoin. This wide range of market instruments provides traders with ample opportunities to diversify their portfolio and explore various trading strategies.

Account Types

TRI offers three types of accounts: ECN Standard, ECN Pro, and ECN VIP accounts.

The Standard account is the most basic account type, with a minimum deposit of $100. It offers fixed spreads and a maximum leverage of 1:500.

The Pro account, on the other hand, requires a minimum deposit of $5,000 and provides traders with lower spreads than the Standard account. The Pro account also allows traders to use Expert Advisors (EAs) and offers a maximum leverage of 1:200.

The VIP account is the most advanced account type offered by TRI. It requires a minimum deposit of $10,000 and provides traders with direct access to the interbank market. This account type offers variable spreads, which can be as low as 0 pips during times of high liquidity. The ECN account also allows traders to use EAs and offers a maximum leverage of 1:100.

Each account type has its own advantages and disadvantages, and traders can choose the account type that best suits their trading needs and preferences.

| Pros | Cons |

| Multiple account options to choose from, including Standard, Pro, and ECN accounts | Inactivity fee charged after 90 days of inactivity, which can be a disadvantage for traders who prefer to take longer breaks from trading |

| Leverage options available up to 1:500, providing the potential for high returns on investment | High commission fees for the ECN account, which may deter traders with smaller account balances from using this account type. |

| Tight spreads starting from 0.0 pips for the ECN account, which can help traders to reduce their trading costs | |

| No deposit or withdrawal fees, which can save traders money on transactionsVarious payment methods available for deposits and withdrawals, including bank wire transfer, credit cards, and online payment systems | |

How to open an account?

To open an account with TRI forex broker, you need to follow these steps:

Visit the official website of TRI at https://www.triltasia.com/en.

Click on the “Open an Account” button located on the top right corner of the homepage.

Fill in the registration form with your personal information, including your name, email address, phone number, and country of residence.

Choose the account type that suits your trading needs and preferences.

Provide additional information, such as your trading experience, source of funds, and other relevant details.

Verify your identity by providing the necessary documents, such as a valid ID, proof of address, and any other documents required by the broker.

Fund your account using one of the available payment methods.

Download and install the trading platform of your choice.

Start trading and managing your account.

Leverage

TRI forex broker provides traders with flexible leverage options, allowing them to amplify their trading positions and potentially increase their profits. The leverage provided by TRI is determined by the trader's account type and trading instrument. For example, the maximum leverage for forex trading is up to 1:200, while for precious metals like gold and silver, it is up to 1:100. It's worth noting that although high leverage can amplify potential gains, it also increases the risk of potential losses. Thus, traders should carefully consider their risk tolerance and trading strategies before selecting a leverage level.

Spreads & Commissions (Trading Fees)

TRI offers variable spreads that depend on the account type and the trading instrument. As a market maker, the broker earns from the spreads, and there are no commissions charged on trades.

For the Standard and Pro accounts, the typical spreads on major currency pairs, such as EUR/USD and GBP/USD, start from 1.2 pips and 0.9 pips, respectively. The ECN account has lower spreads, starting from 0 pips, but also involves a commission of $6 per lot traded.

For other trading instruments, such as commodities, indices, and cryptocurrencies, the spreads also vary depending on the account type and market conditions. However, TRI's spreads are generally considered competitive compared to other brokers in the industry.

A comparison of TRI's spreads on EUR/USD, major indices, and gold with FXTM and XM:

| Symbol | TRI | FXTM | XM |

| EUR/USD | 1.2 pips | 1.3 pips | 1.6 pips |

| DAX | 2.5 pips | 1.8 pips | 2.5 pips |

| DOW | 4.5 pips | 3.2 pips | 3.7 pips |

| Gold | 36 pips | 30 pips | 33 pips |

*Please note that these spreads are subject to change and may vary depending on market conditions and the type of account held by the trader. It is important to compare spreads and other trading costs when choosing a broker.

Non-Trading Fees

TRI charges various non-trading fees, such as inactivity fees, swaps fees, and account maintenance fees, among others.

Regarding inactivity fees, if a trader does not place any trades or activities for a certain period of time, TRI may charge an inactivity fee. However, the exact amount and time frame for this fee depend on the account type and may vary.

When it comes to swaps fees, they are charged when a trader holds a position open overnight, as it incurs a cost to keep the position open. These fees also depend on the account type and the trading instrument, and they can be either positive or negative, depending on the direction of the trade.

In terms of account maintenance fees, TRI does not charge any specific fees for account maintenance. However, traders should always check with their payment provider if any additional fees are applicable, such as wire transfer fees or credit card processing fees.

Trading Platforms

TRI offers the popular trading platform MetaTrader 4 (MT4) to its clients. MT4 is a user-friendly platform that is widely used in the forex industry, known for its stability, reliability, and advanced charting capabilities. It allows traders to place orders, access advanced trading tools, and analyze the markets using a variety of technical indicators and charting tools. Additionally, the platform supports automated trading through the use of expert advisors (EAs), allowing traders to automate their trading strategies.

TRI also offers the WebTrader platform, which is accessible through any web browser and does not require a download. This platform is particularly useful for traders who are on the go or do not have access to their desktop computers. The WebTrader platform provides traders with real-time quotes, advanced charting tools, and the ability to execute trades directly from the platform.

Here's a comparison chart of TRI's trading platforms with two other similar brokers, IC Markets and FXTM:

| Trading Platforms | TRI | IC Markets | FXTM |

| MetaTrader 4 | ✓ | ✓ | ✓ |

| MetaTrader 5 | ✓ | ✓ | ✓ |

| cTrader | ✓ | ✓ | × |

| WebTrader | ✓ | ✓ | ✓ |

| Mobile Trading | ✓ | ✓ | ✓ |

| Social Trading | × | ✓ | ✓ |

| API Trading | ✓ | ✓ | × |

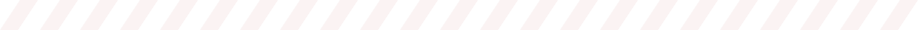

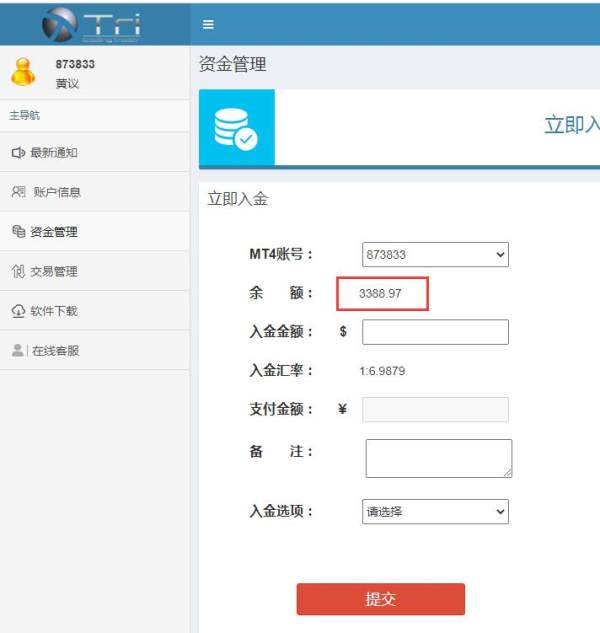

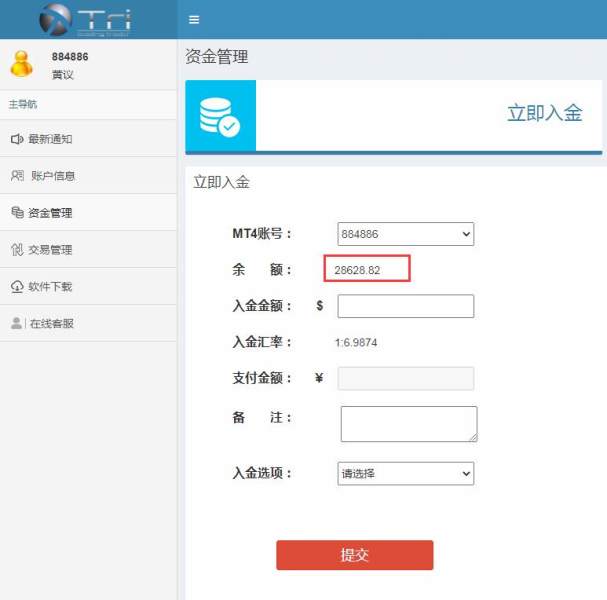

Deposit & Withdrawal

TRI provides several deposit and withdrawal methods to its clients, including bank transfer, credit/debit cards, and e-wallets such as Skrill and Neteller. The minimum deposit amount varies depending on the account type, with the Standard account requiring a minimum deposit of $100.

TRI does not charge any deposit fees for any of the deposit methods. However, it is important to note that the payment provider may charge its own fees.

When it comes to withdrawals, the processing time may take up to 5 business days depending on the payment method. TRI does not charge any fees for withdrawals, but as with deposits, the payment provider may charge its own fees.

Here's a chart comparing the pros and cons of TRI's deposit and withdrawal methods:

| Pros | Cons |

| Multiple deposit methods available | High withdrawal fees |

| Deposits and withdrawals processed promptly | Limited number of supported currencies |

| No deposit fees | Only one free withdrawal per month |

| No fees for internal transfers between accounts | Inactivity fee charged after 3 months of inactivity |

| Minimum deposit amount is low | Limited options for payment methods |

Customer Support

TRI offers multiple channels for customer support, including email, phone, and live chat on their website. They have also provided a FAQ section on their website that covers many common questions and concerns. However, there have been some negative reviews of their customer support, particularly in terms of response times and effectiveness in resolving issues.

Here are some contact details about this broker:

Telephone: +35722030913

Email: support@triltasia.com

Conclusion

TRI is a UK-based forex broker that offers a variety of trading products and services to its clients. The broker provides a range of account types, different trading platforms, and competitive leverage levels. However, despite its offerings, it is important to note that TRI has received a large number of complaints from traders, particularly in relation to its customer support and withdrawal processes. Traders should carefully consider these factors before choosing to trade with TRI.

FAQs

Q: What is the minimum deposit to open an account with TRI?

A: The minimum deposit for a Standard account is $100, for a Pro account is $5,000, and for an ECN account is $5,0000.

Q: What trading platforms does TRI offer?

A: TRI offers the popular MetaTrader 4 (MT4).

Q: Does TRI offer a demo account for practice trading?

A: Yes, TRI offers a demo account for traders to practice and test their trading strategies before opening a live account.

Q: Does TRI charge any inactivity fee?

A: Yes, TRI charges an inactivity fee of $50 per month if there is no trading activity on the account for more than 90 days.

Review 142

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now